Updated on December 14, 2023

Do I Keep or Cancel / Downgrade my Chase Sapphire Reserve?

If you are asking yourself whether you should pay the $450 annual fee / keep the Chase Sapphire Reserve for a 2nd year, the answer is YES. It's a question I keep hearing. There is, however, no downside in calling Chase to check for retention offers. This is the way I would recommend phrasing it:

Hi, I am considering cancelling my Sapphire Reserve card because of the $450 annual fee. Do you mind checking to see if there are any retention offers that may incentivize me to keep it for another year?

PS – Don't miss this hot deal to get $200 Amazon Gift Cards when you buy $400+ flight on Upside.com. It ends 8/31/17.

Main Reasons for Renewing / Keeping

- $300 travel credit for 2018 for those who were approved prior to 5/21/17 (so your fee is now really $150)

- Priority pass that comes with an unlimited guest policy

- 3X earning on all travel and meals/entertainment

- 1.5c value for travel redemption made through the Chase Ultimate Rewards portal

- Fantastic travel insurance although I would still recommend booking flights using the Citi Prestige

Even if you hold most of these bullets as low-value items, you should AT LEAST renew and keep until Jan 2018. The next section explains why:

NEW Reason for Renewing / Keeping

Comments section from the Doc's recent post suggest that the annual fee is PRORATED:

Last week, I product changed my Chase Sapphire Reserve to Chase Freedom Unlimited a few days before the 1 year mark. I wasn’t offered anything during my phone call. I received a credit of $37.50 for 1 month of annual fee refund though.

and

I similarly PC my CSR to the Freedom a few weeks before my annual fee and noticed a $37.50 credit.

If you do not anticipate having organic spend in the travel category during Jan 2018, you can simply purchase a $300 AA electronic gift card and that will trigger the $300 credit. Just bear in mind that the $300 travel credit resets after your December statement close. For example, if your December statement close date is 12/3/17, that means you can begin using your 2018's $300 credit beginning 12/4/17.

Should I Cancel or Downgrade Come Jan 2018?

I must re-emphasize that I highly recommend keeping the Sapphire Reserve open so long as the benefits remain unchanged. If, however, you truly do not get value out of the card other than the $300 travel credit, I would recommend you DOWNGRADE the card instead of cancelling. With the 5/24 rule in place for the majority of Chase cards, it is becoming extremely difficult to get approved for new Chase cards. Downgrading to the Chase Freedom or Freedom Unlimited is the way to go:

- Chase Freedom: Rotating Quarterly 5X categories

- Chase Freedom Unlimited: 1.5X on all categories

What is TheRewardBoss Doing?

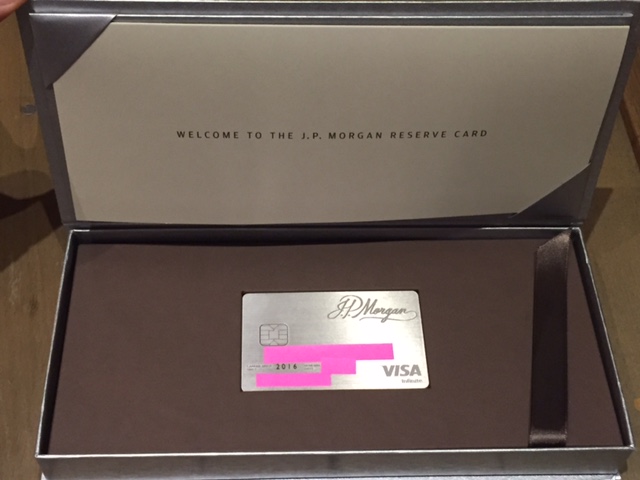

Personally, I do not carry the Chase Sapphire Reserve – I was way over 5/24 and was not pre-approved in branch. However, I do carry the JPM Reserve card, which arguably is superior, not just because of its 0.86ozt weight, but because it also comes with United Club Membership. Between this card and the JPM Ritz Carlton Card, I have the 2 best cards JPM/Chase have to offer.

Looking for the perfect card?

Check out the credit card directory or feel free to ask in the comments.

The .86oz weight is the biggest disadvantage to the JPReserve Card. There’s nothing more disgusting than being behind someone in line who lets one of those metal cards clank down on the counter just to impress. Plus it weighs down your wallet. I have the CSR and Chase was great about mailing me a regular plastic version of the card just by calling and asking. They also mailed me a postage-paid return mailer to send back the metal card for recycling.

How did you qualify for the JPM Reserve? Do you have a significant investment with JPM?

Take a look at the JPMR links above. It’s all explained there.

Do you know any other way that I can get the JP Morgan Reserve now that the fax number has been disconnected?

Hold $10MM in assets w JPM