Updated on December 14, 2023

Ritz-Carlton Rewards Credit Card

Step aside, Sapphire Reserve – your buzz has now worn off. There's a new #1 in my book – it's the Ritz Carlton Rewards credit card. Technically, it's a JPM issued card, but what's the diff these days since it all rolls up to Chase. What compelled me to sign up for this card a few months ago was the Doc's warning that the signup bonus of 3 free nights would be soon dropping to 2 nights. I immediately signed up (and approved), and within a couple of weeks, the last working links eventually died.

Note: This card is NO longer available for new applicants, however, you might be able to upgrade one of your existing Chase cards to this card.

So What's So Good About the Ritz Carlton Card?

On the SURFACE, here are the perks:

- $300 annual travel credit (worth $600 first year since you get $300 for 2017 and another $300 for 2018)

- It requires calling up to get charges reimbursed but it is quite easy (versus the Sapphire Reserve which happens automatically)

- The credit was intended for seat upgrade, in flight purchases and lounge access charges, but I have been able to get reimbursed for taxes and fees on award tickets

- Signup bonus of 2 free nights at any Ritz Carlton property, tier 1-4

- Here are the best uses of the certs

- 1 Free Night certificate up to 50k points every year

- The Ritz card does not follow 5/24 rules

- 3 club level upgrade certificates per year on paid stays

- Limited time only, $25 back with Apple Pay

Real Gems of the Ritz Card

There are 2 main reasons why the Ritz Carlton card is the most underrated card in the Chase portfolio:

- Priority Pass for you, as well as each of your authorized users

- Comes in handy for those family members who refuse to sign up for credit cards, yet you want them to have airport lounge access when they fly. Just add them as authorized users and they can get lounge access.

- $0 cost to add authorized users, up to 6. Relative to Citi Prestige, Citi wants $50 for each. Relative to Sapphire Reserve, Chase wants $75 for each

- Lounge access comes with unlimited guests too

- [This benefit has been discontinued] $100 Visa Infinite Companion Airfare Discount

- Book round trip domestic airfare for you and a companion, get $100 off each booking, unlimited uses

- Works for authorized users as well – my most recent booking, I was able to book 8 passengers on 4 separate reservations and score 4 x $100 discount on a domestic round trip flight

- Instructions on how to book

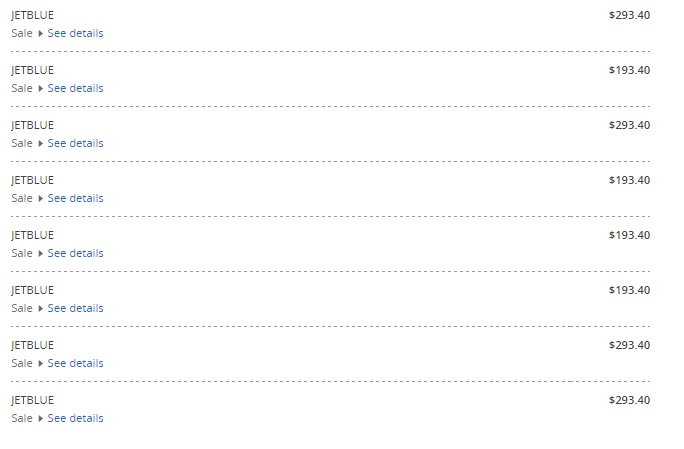

- Check out how the discount gets applied – The first ticket gets charged the full price and the second ticket has the $100 discount applied. And as you can see, 8 tickets purchased of which 4 of them reflect the $100 discount.

Heaviest Metal Card?

Weight might not be a driver for most, but it surely is icing on the cake for me. The Ritz card is the heaviest metal card out there, weighing in at a full 1 oz! To say the least, it's a conversation starter.

Close Competitors

As many of you know, I have been a JPM Reserve cardholder for 8 months now and I must say, the JPM Reserve card is a very close 2nd place. Unlike the Chase Sapphire Reserve card, the JPM Reserve comes with United Club membership so that's a value of $450-$550 depending on your United status. Ritz Carlton Rewards still wins the race mainly because of the unlimited uses of the $100 visa infinite companion discount, including authorized users.

Long Term Plan

When I first applied for the Ritz Carlton Rewards credit card I wasn't sure how long I would keep it. Since then, the Ritz card has really grown on me – the new love of my credit card life. Working out the math, $450 annual fee, partially offset by the $300 annual travel credit, gets me to an effective annual fee of $150. Depending on how much you are able to leverage $100 visa infinite companion discount and the Priority Pass for authorized users, you will come out hundreds if not thousands ahead per year.

So my long term plan is to keep the Ritz card until (if) Chase devalues the 2 big gems. The Ritz will compliment my JPM Reserve card, which I also plan to keep paying the annual fee each year.

Get The Card

Learn more about this card on the Chase website. I do not earn anything if you apply for this card but you support my blog by using my credit card offer directory (many thank you's if you do!).

Other Favorite Offers

Another Chase offer I like right now is the British Airways up to 100,000 sign up bonus.

Is this card subject to the Chase 24/5 rule?

No it does not follow 5/24 – will update post to make this notation – thanks.

Any Any update on getting the JPM Reserve Card?

Not possible for most. One exception is a friend who has a few million w chase but not quite $10MM to qualify for JPM private – had his chase guy contact a JPM guy who put through the app for him. Was eventually approved. HUGE YMMV.

So between ritz, csr and amex plat…what would keep and drop

amex plat = drop it. here’s why: http://therewardboss.com/maximizing-amex-ameriprise-platinum-perks-benefits-american-express-plat-charge-card/

Ritz: keep, for reasons stated above

chase CSR: keep, effective annual fee is $150 after $300 annual travel rebate. 3x on all travel and dining is huge in my book, represents the majority of my monthly expenses. on top of that, you want to maintain that 1.5c min valuation of UR pts. reserve, whether JPM or Sapphire, is a keeper so that all your chase UR pts get upgraded to 1.5c

though not asked, sapphire preferred: drop

Priority Pass – Up to 6 AU for Free? Can you tell me where you received that Data Point. That is new information for me. Wonder when they imposed that Rule – you seem to be the first blogger who has found it.

Google “ritz carlton chase authorized users priority pass” and you will see a host of results supporting this claim. Here’s one for example: http://onemileatatime.boardingarea.com/2016/10/14/ritz-carlton-card-authorized-user-benefit/

For reference, I have done this myself. My authorized users have Priority Pass, for free. The only annoying part was that it wasn’t automatic. Each AU required me to send a SM to Chase asking for the Priority Passes to be shipped.

getting reimbursed for taxes and fees….what do you tell them it is for to get them to reimburse you?

They didn’t ask. I have called up 4x so far. I tell the the date, the charge amount, and the merchant (e.g. AA). No questions asked and the credit gets entered. Every time, it’s an easy 2 min call. My amounts have ranged from $5 – $55

Don’t forget to add SPG/Marriott/Ritz gold status free first year, free if spend 10k/year on it subsequent years. Huge perk IMHO.

Fair point generally speaking. However, I would argue that the opportunity cost on that $10k hurts! that $10k charged on the ritz card could have been better charged elsewhere (e.g. 3x travel / dining for Reserve or perhaps 5x on flights for Amex Plat). Further, Amex Plat gets the primary holder SPG Gold status AND Hilton Gold status (no spend required). Might be a better move to be an Amex Plat holder just so you don’t have to drop $10k annually on the ritz. It hurts me just hearing this!

See if you can get some ideas from here: http://therewardboss.com/maximizing-amex-ameriprise-platinum-perks-benefits-american-express-plat-charge-card/

i’ve heard that redeeming the free night certs are difficult, and applying club level upgrades is another obstacle. did you run into this issue? how many ritz points = starpoints?

ritz pts is the same as marriott pts. 3 marriott pts = 1 spg pt

i have not redeemed my 3 certs yet, although I was previously booked for Ritz San Fran for Fri – Mon in July and had no issues booking online. I eventually had to cancel the rez because plans fell through. in case i am misunderstanding your question, and you truly meant “how” to book, see lucky’s detailed post: http://onemileatatime.boardingarea.com/2016/11/29/how-to-redeem-ritz-carlton-free-nights/

I have and love this card , literally just used my 3 free nights for the Ritz Carlton in Maui , was upgraded to a suite room which ranged from 1238-1560 a night and I got it for the 35 dollar a night resort fee….I booed it online and in the payment section u just click on the certificate payment box and that’s it,m. I called to add my club level upgrade, I had to book that over the phone BUT I was also able to get the 100 credit for booking for 2 night or more

can you please clarify? you were able to apply 1 of the 3 club level upgrades to your 3 free night certs (i.e. non paid stay) and then somehow the property upgraded you further to a suite (i am guessing because of your status)?

Is the Ritz sign up bonus 2 free nights or 3 free nights?

it WAS 3, now it’s 2. don’t bank on 3 coming back – looks to be a permanent change

Will gift card purchases from Southwest be reimbursed?

can’t say for sure. if your increments are low, let’s say $50 per charge, there’s a good chance you will get reimbursed. a part of me wants to say the chase rep that’s helping you put in the reimbursement claims, simply does not care. they are not out to get you. another part of me says, as long as it’s reasonable and looks like to be in the ballpark of a seat-upgrade charge (which is > couple hundred for international flights), they will reimburse. remember, the 4 reps never asked me what the charge was for. they reimbursed without asking questions.

although i would not recommend doing this (lying about it), i had 1 friend who outright booked a flight for ~$400, and got reimbursed for $150 because he told the chase rep $150 of it was for a seat upgrade.

Can you use the $100 airline benefit on Southwest?

See my comment above

I actually meant the Visa Infinite $100 airline discount.

No it cannot

Glad to hear you like this card. I have had the Ritz card for 4 years and have used the club upgrade coupons faithfully for week long stays all over the world. Yes, the rooms will cost more than the competition, but none of the clubs in other hotels can compare to a Ritz Club.

And if you are used to carrying your wallet through any airport security, you should put the wallet or your Ritz card in your carry-on as the metal tends to trigger alarms. It’s a small price to pay for heavy metal.

Where do see hilton surpass in all this

One and done. Sign up for the current 100k offer, pay AF the second year to get the anniversary free night cert. After that, no real compelling reason to keep since the cert is 1x only. In fact if you time it right, go for the Citi Hilton reserve card ~1 year after surpass signup so you get 3 free weekend certs to use back to back. The 100k will give you option to take on a 4th night either thurs or Mon night.

Thanks….so what do you say with a wallet carrying the following

Ihg reward, csr , hilton surpass, amex plat schwab, united club, chase freedom, chase unlimited, capital one venture

you’re missing the best chase card…

At the end of the day, what you carry is based on your travel / spend habits. I do like that you are maximizing the UR bonus earning potential on the personal cc side. Would prob suggesting adding ink preferred to your wallet as a keeper for the biz side. 80k signup bonus and the gem for keeping is the cell phone insurance coverage for you and your “employees”. Go in branch and apply through a BRM and you got yourself a 100k offer.

I thought your statement that it gives access to the United Clubs was interesting. I have CSR, but no longer travel internationally. That makes the CSR worthless for club access.

Being able to use the credit for seat upgrades is nice. Economy seating has become an outright disaster, at least on United.

Question. I guess you need to charge your ticket or taxes if an award ticket, to this card, to use the upgrade credit. Does this card have the same travel emergency benefits as the CSR? Hate to give that up.

Yes identical

When using the 3 club level certificates you should call for rates, it cannot be any discount rate and you can also use the $100 credit on 2 nights or more. The club level has good food and drinks, you can easily make a meal, some may have an omelette station or bloody Mary bar and very attentive staff. I’ve had this card 3 or 4 years and will keep it!

Does the authorized user get gold elite status like the primary user, or as long as the primary user has gold elite staus?

Primary only since all cards earn pts linked to 1 Marriott / ritz account

When you buy jetblue ticket using this perk, do you earn qualifying mile for mosaic or true blue mile?

Yes

When using $100 discount perk on jetblue, do you earn qualifying mile for mosaic or true blue mile?

You said you get reimbursed for taxes and fees on award tickets, how did you do?

I’m thinking about booking award business class using ANA to Asia; I need to pay around $500 for taxes, fee, fuel charge. Do you think they would reimburse me? Thank you

Yes on the earnings.

YMMV but you would call chase and simply tell the rep date and charge. I have never been asked what the charge was for. However friend of mine was asked and he said X amount of Y charged was for seat upgrade and was reimbursed.

The terms state “Ticket must be purchased in full using a U.S.-issued Visa Infinite card”. What happens if you pay with the chase sapphire reserve since it is labeled as a Visa Infinite card?

Reserve does not qualify for this $100 perk. Only JPM Ritz card.

I have seen posts about being able to upgrade from basic economy on delta flights while using the Visa air infinite $100 companion discount at end of booking. Is this also possible with United flights on booking?

Unsure. Based on what I have seen, the site does not display basic economy flights, only shows economy but not 100% sure.

how does it compare vs the amex platinum?

Get both