Updated on April 6, 2017

For a limited time, Citi is offering a 50,000 Bonus for the Citi Prestige® Credit Card after a $3,000 spend in 3 months!

Citi's latest credit card offer gives you at least $1350 of value (less the $450 annual fee). The required spend is only $3,000 in 3 months.

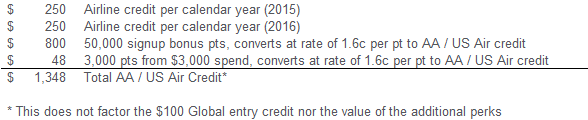

If you plan to book AA / US Air flights within the next 365 days, you will get at least ~$1,350 worth of airline credit from the Citi Prestige® card – far exceeding the $450 annual fee. Calculated as follows:

LINKS

Annual Fee: $450 (big but keep reading to see why its worth it)

WHY YOU SHOULD GET IT

Citi has made a really attractive bonus on their Prestige card which was previously only 30,000. Here are the main benefits:

- The annual fee is $450 but you get $250 in Air Travel credit each calendar year. That means you can get $250 credit in 2015 and 2016 so you make $50.

- Redeem points for a $800 flight on American Airlines or US Airways®, OR

- Redeem points for a $665 flight on any other airline or $500 in gift cards

- 50,000 miles with 11 airline transfer partners (but I think I would rather redeem it for an $800 flight)

- Lounge access to Admirals Club and Priority Pass Select (more lounges)

- $100 Global Entry Application fee credit

- No foreign transaction fees

- 4th night free on any hotel stay (I rarely pay for hotels so this does not give me much value)

- Earn 3x points on Air Travel and Hotels, 2x on Dining/Entertainment, 1x per $1 spend on other purchases

TRANSFER PARTNERS

Citi ThankYou® Premier, Citi Prestige® and Citi Chairman® cardmembers can transfer points to the following partners at a ratio of 1 to 1:

- Air Asia Miles

- EVA Air Infinity MileageLands

- Etihad Guest

- AirFrance / KLM Flying Blue

- Garuda Indonesia Frequent Flyer

- Malaysia Airlines Enrich

- Qantas

- Qatar Airways Privilege Club

- Singapore Airlines KrisFlyer

- Thai Airways Royal Orchid Plus

- Virgin Atlantic Flying Club

- Hilton HHonors (I wouldn't use this)

SUMMARY

The value in this card wasn't obvious at first but this is a great offer! I already have Global Entry so although I wont benefit from that or the 4th night free, I am still going to apply for this. If you don't think you will benefit from all the perks then the annual fee is probably not worth it just to get the 50,000 bonus.

Are these perks valuable for you? Do you plan to sign up?

Hat Tip to ViewFromTheWing, OneMileAtATime, and MileValue

RELATED

- Citi Premier 50K Bonus – Tip to Score $848 AA / US Air Credits (instead of $662)

- How To Get $800+ In Airfare With The Prestige Card

I was going to apply for this but one thing holds me back. In the past reading their tc’s I saw that if you redeemed with AA flights you would get the 1.6cents, however they don’t seem to publish that ever since they modified the prestige, premier and preferred. I also called thankyou a few weeks ago and they said points were not different. Can you help clarify, I would hate to get this card and not get the 1.6 with AA or US air

Nick – take a look at the screen shot “enough points to redeem an $800 flight on AA or US Air”. This is directly from their website. Also check out the screen shots posted by ThePointsGuy here.

lucky confirms here as well: http://onemileatatime.boardingarea.com/2015/04/10/how-to-get-800-in-airfare-with-the-citi-prestige-card/

Does this card only give 1x on Gas?

Yes – from the terms and conditions:

Unless you are participating in a limited-time offer, you will earn:

3 ThankYou Points for every dollar you spend on purchases at airlines, hotels and travel agencies and you will earn

2 ThankYou Points for every dollar you spend on purchases at restaurants and select entertainment merchants, including sports promoters, theatrical promoters, movie theaters, amusement parks, tourist attractions, record stores and video rental stores.

1 ThankYou Point for every dollar you spend on all other purchases.

I’m looking into jumping on the credit card churning boat.

This card caught my eyes.. I have a few questions:

1. When do you cancel this card in order to avoid the 2nd $450 annual fee?

2. When cancelled, do you retain your points, travel credit, Global Entry?

3. Are you still able to use the Admiral Lounge access passes after the card has been cancelled?

Thanks!

1. You can even wait the entire full year until 2nd year fee hits and cancel within 30-36 days and have the 2nd AF refunded.

2. You lose all perks when canceling. For TY pts, you may want to sign up for the premier card right around the 12 month mark so the pts merge and will be active while the premier is still active.

3. No