Updated on July 9, 2019

AMERICAN EXPRESS CREDIT CARD APPLICATION STATUS

After you apply for an American Express credit card online, you may not get instantly approved. Don't panic! That doesn't mean you were denied. You can easily check the status of your application at any time online. Here's how you do it and the steps you can take to turn your “pending” or even possibly a rejection into an approval. This is what I saw for a recent American Express card application.

Check Your Amex Credit Card Application Status

There are two easy ways to check your American Express Application status. I suggest checking online first and you'll notice it is super easy and you find out the results in a few seconds. The second way is by calling American Express. Both methods are explained in detail below.

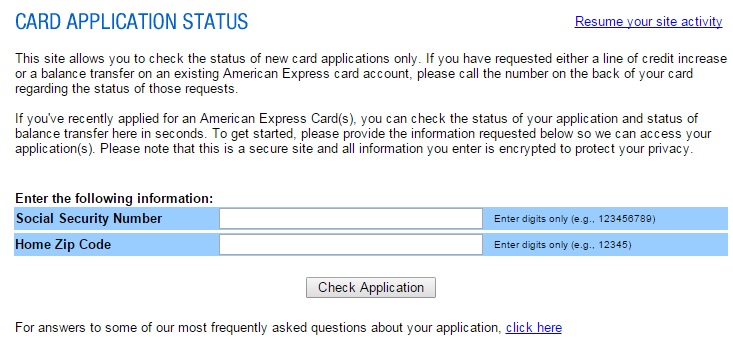

How to check your American Express Application Status ONLINE:

The fastest and easiest way to check your application status online. Follow these steps:

- Go to American Express Card Application Status website.

- Enter your social security number and the zip code you entered on your credit card application.

- Click “CHECK APPLICATION”.

Often times, I find that Amex does not instantly approve new credit card apps. For whatever odd reason, they wait 1 minute before approving, so after each Amex credit card application, I immediately load the American Express Card Application Status website and am always pleasantly surprised that it shows APPROVED!

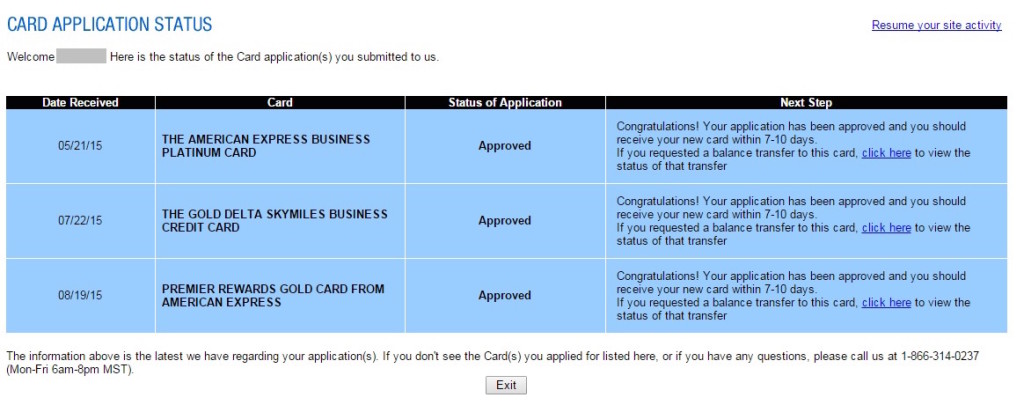

Here is an example of the results:

Status of Application Explained

Approved: Nice! Check the next step on the right side to find out when your card is arriving.

In Progress: You may have an option on the Next Step to click a button a provide more information they need. I recently had this happen where they needed to know the business structure (Incorporated, Partnership, or Sole Proprietor). After I submitted this additional information the status notes changed to “Please check back on this site in 24 hours”.

Cancelled: If you don't know why the status says cancelled you should call the Amex reconsideration line below to find out what happened.

How to check your American Express Application Status by PHONE:

- Call 800-567-1083 or 866-314-0237 (M-F 6-8pm MST).

- The system will ask “are you calling to apply for a new card or check the status of your application”. Say “Yes”.

- Next, say “status” to get the right team.

CALLING American Express – Reconsideration Phone Line / Number

If the American Express application status does not show “Approved”, the next step is to speak with a rep. The phone numbers provided below have been typically called the Amex Reconsideration Phone Number, but realistically you can call even if your application has not been rejected yet and is merely pending.

If your Amex application status is denied or pending, you can call 800-567-1083 or 866-314-0237 to speak with a live credit analyst. Credit analysts have the power approve you over the phone – so be nice!

I have also found the credit analysts to be the most lenient at Amex vs. the other big banks. Amex might still be hurting from their recent loss of Costco and will go the extra step to acquire new customers (just my theory).

What to Say to the Amex Credit Analysts

Remember – the Amex credit analysts have the power to approve you over the phone, so you want to be as accommodating as possible. I have found conversations with Amex and Chase credit analysts to be VERY similar, so rather than rehashing what's already been posted, please see the tips on what to say to Chase credit analysts.

The only part that diverges is my recommendation on small business credit cards – Chase has been really strict on approving business credit card applications but American Express is still equally as lenient with business apps as with personal apps.

In the rare event the credit analyst does not budge on approval, politely hang up and call again to get a different credit analyst. Often times, the decision is a judgment call and you want to catch the right rep at the right mood. If still no dice after 3 different credit analysts, ask to speak to a supervisor and plead your case. Again, it is YMMV, but this is where you really need to sell yourself. If its a few missed payments on your credit report that's holding you back, surely there is a plausible story of why that happened where he/she can sympathize, right?

If they ask why you want the new card, be prepared with a reasonable reason other than just collecting the sign up bonus. Perhaps the card has a benefit that is attractive such as resort fee credit on the Hilton Aspire card, free baggage on a Delta flight, or something else unique to that card.

Maximum Number of Amex Cards

Keep in mind that the maximum number of American Express credit cards is FIVE (5). It used to be four but I recently had 5 cards and wanted to apply for a Delta Biz Platinum Card offer. They said that I've hit the maximum of 5 cards and that I'd have to close one credit card if I wanted to get it. This limitation only applies for credit cards (personal and business cards combined) and NOT charge cards. I learned the hard way about this rule, but don't worry, hope is not lost.

Call up Amex to cancel one of your credit cards. Then call back the reconsideration phone number and ask the representative to reconsider / reprocess the application. The application goes from DENIED back into IN PROGRESS stage without an additional hard pull. If you have reached this point, the underwriting team is the unit that reviews the application, and unfortunately, they are not customer-facing, which means you will just have to hang tight for a couple of weeks.

What's a the difference between a “charge” card and a credit card? The Green, Gold, and Platinum cards are all charge cards. The other cards such as SPG/Marriott, Business Blue, and others, where you will be assigned a credit limit, a “credit” cards.

When will I receive my new Amex credit card? How long does it take to receive my new Amex card?

The application status website will tell you the card will arrive in 7-10 business days. In my experience, however, most premium (higher annual fee cards), get expedited and are automatically sent by FedEx or UPS and arrive a few days later.

On my most recent card application, since I had to call close one card to make room for another one, I asked them if they could expedite it. It would likely get expedited anyway but I want to bring the card on my next trip to use some of its benefits right away.

American Express Refer a Friend

Most Amex cards offer a bonus of extra points if you refer a friend. You can find the links by logging into your account and searching for “Refer a Friend” or use this link which will take you directly to the page you need.

How many times can I receive the Welcome Bonus?

Once. You can receive American Express credit card welcome bonus points only once per lifetime per product. In the past you could cancel a card and in a couple years apply again and get the sign up bonus all over again.

But: Amex may not really keep track forever. In fact, data over 7 years old may be purged. You can ask Amex to check if you've ever had a credit card and they will check their records. This may work but it's no guarantee. I had a chat rep say that I never had a card and then later I didn't get the bonus because I had the card before.

But #2: Remember that it is once per product! For example, the Delta card has 6 different versions which means 6 different products. It could take you quite some time to get each of these.

TheRewardBoss Amex Card Recommendations

See this page for the most recent credit card offers.

I applied Everyday Preferred and got instant approval but then the next day on Sunday I applied the business Platinum card and it was pending and want me to give them a call. I guess is because of Sunday, so I check online from your link and the result showed ” in progress.”

So I patiently waited till Monday received an email says : ” We are excited that you’ve decided to apply for the Business Platinum Card®, and we’re reviewing your application now. We promise to let you know when we’re finished, or if we need more information. While we’re reviewing your application, please don’t apply for another Business Platinum Card®. Thank you for your interest in American Express.” After another day my card was approved without even need to call them back!

Hi , I really need your help an advice , I recently applied for the SPG Personal an business together, (along with the blue cash preferred).

(I had 3 other existing Amex credit cards at time of applying.)

I was instantly approved for the SPG personal, the business was pending . Few days later I got an email that I was declined “our records indicate that you have the max amount of accounts an types of cards that we allow”.

(The SPG personal was really my 4’th card)

I tried to contact them an offer to close , they said that first I need to close an existing , then they WILL have to pull my credit an see if they can approve me , they said that for this particular application there was still no hard pull done, when I said that they pulled it already for the personal which I did together with the business they said that it was done for the personal an not for that particular application .

Bottom line , I can close 1 existing account , but not guaranteed that they will even approve me for the new one , plus they will make an additional hard pull on my Experian report , what can I do for this ??

Thanks in advance .

That’s correct. I made the same mistake before and had to close one first then call back recon and it went in pending for about a week before they approved me for the new app. Unfortunately if you are trying to dodge a hard pull for the biz app, I can’t opine on that.

Applied for Gold Delta Skymiles Amex Personal and Business today. Personal was instantly approved. Business card went to “In Progress” status. I called the recon line for application status. I told the guy on the phone that I had applied for both at the same time to start a relationship with Amex (first Amex cards for me), and I explained my personal was instantly approved but the Business was still in progress and that I was calling to check if they needed some additional information or verification. He explained to me that it was automatic to stop the second application for fraud prevention. I asked if there was anything I could do to verify it was actually me, and he said “of course, we appreciate you taking the time to call in.” After verifying the details of my application, he not only approved my second application but told me that he was overnighting my new card so that I could use it right away. I suggest calling in right after doing the second app in the same day because it has hopefully saved me a second hard pull.

I applied recently for Amex and my application was not approved. Credit scores of 688/667/690 and needless to say I am not pleased. Followed up with customers service for reconsideration and the review remained the same. Second and last time that I will apply for an Amex.

Same thing happened to me and so done with them as well. Went to Chase and was approved instantly without any drama and conflama. I say check with another issuer.

ok good

I got denied today called reconsideration dept and she sent me for manual review and they will contact me. What should I do

So I applied for the blue cash everyday card and got a notification that they’re reviewing it and not to apply for another blue card. Will it do harm (aside from another HP) to apply for a regular every day card?

I also checked the status and its not showing my application there. Only an application from back in April of this year which I was declined for.

I also applied for the everyday card but when I check the status it says that my application cannot be located even though I got the email saying that it is under review.

I applied for everyday blue card and the in progress status since 12/13/16. Should I assumed that the application is denied?

No

yes it is

I applied for a Amex Plenti Card and needed to send in address verification info. I have done that and there is no update on my status. I did however receive an acknowledgement email that they received my paperwork requested. This Wednesday will be 48-72 hrs since I received the acknowledgement of the received documents. How much longer must I wait? Should I just count out an approval on this card? I began this application process on December 18, 2016…today is the 3rd of Jan 2017. (Happy New Year). What should I do?

Wouldn’t count out an approval. In fact, I would bank on the opposite since this is request is fairly easy to satisfy. Also need to bake in the holidays so hang tight.

I applied for a card and was mailed a letter a week later stating I was denied. I called the reconsideration number and the guy just said he would submit it to a team that manually reviews the application. About a week later I received another letter stating I was denied. Scores are TU 644, Eq 681, Exp 675. Any tips or is this worth trying any further?

What’s the reason you were denied (should be stated in the rejection mail)

I believe it said said too many inquiries within 12 months, and a delinquent account. The delinquency was not valid and has been removed from Equifax and Transunion but hasn’t been from Experian yet. I tried to tell them that but they said they only run Experian.

It’s the delinquency that’s driving the rejection. Contact Exp. to get your report corrected and then call the recon line again. If it has surpassed the time frame of reconsideration then just apply for the card again.

the bank is worthless

Hello, I applied for an American Express Green Charge card on 2/23/2017 and was denied since they were unable to obtain a FICO score from Experian. I am new to credit and my longest history is 5 mos. Technically if I waited for another week my odds would have been different. A week later I had checked into Experian to find out my Fico score and it was already listed as 742. Upon reading some comments and tips you had given, I had called their recon line and the credit analyst did not give me any more information other than saying that she will forward it for manual review. My Transunion is 658 and EQ 662 no negatives on all three. But with some hard hitting inquiries 8 on Transunion, 4 on EQ and 3 on EX. Should I even hope?

While the score itself plays a big role, what factor drove the score increase? It may be beneficial to be prepped to speak to this factor when you are otp w the rep. While the rep might not bring it up at first, he/she sees what’s driving down your score and it’s best to talk about the elephant than to avoid it.

Awesome info. I checked the amex reconsideration website after about 15 minutes of applying. I was able to see the approved status. Thanks!

What is the reconsideration website

I just tried to recon a cli and was told by Amex that credit analysts don’t speak to customers and never have. What’s the deal there? He told me they just send it to recon but I can’t actually speak to anyone about it.

Huca

CK 668 TU / 597 EQ and 654 EX FICO

Good approval odds on Credit Karma for the Blue Everyday card. Went to prequalify on Amex website, received offer for Blue Cash Everyday and AMEX everyday. Applied with rep over the phone and was denied. Received email instantaneously denied for: high revolving balance (error due to a closed acct which should be showing as 0 balance; currently disputing with Experian), high loan balance (student loans), derogatory items (paid tax lien), recent late payments (10 months ago) . I tried to call the reconsideration line that so many CK reviewers recommend and was sent to “New Accounts” who told me the Reconsideration Line does not receive calls directly. Also they would review my application, possibly do another hard inquiry, and send me another response via email. I believe the reps were in India and were annoyed that I was even asking for the Reconsideration Line which means tons of people must be calling to speak to them. I didn’t do the reconsideration because I didn’t want to waste another inquiry just to be told no again.

Super annoyed that I wasted an inquiry but lesson learned to not trust even a “Good” approval or a prequalification from the Issuer’s site. I had Very Good odds for the Gold Delta Sky Miles card but didn’t want to pay the $95 fee. Just wanted to get rewards and have a higher credit limit to boost my score.

I applied for the amex everyday card they said to send in proof of address do you think there going to deny me?

Nah. Sounds very easy to prove

Hi. I’ve been overseas for 10+ years and found my credit bureau files non-existent. After a lengthy app process (4506-T, copies of bank statements, paycheck, etc…Amex approved me for the legacy Green Charge. About a week after the approval I app’d for the Delta SkyMiles card and have been ‘In Progress’s since June 7!!! I called and they wanted another 4506-T which is odd as I haven’t paid taxes in 10+ years and they already know this from the previous app. Have you ever seen an application take this long?!? Any suggestions? I’m about to write the Executive Office.

I do not unfortunately.

I applied for an AMEX Business Gold Card. It has been “in progress” for 10 days. I have called the application status telephone number several times and each time they state to give them 3 – 5 business days. It has been well over that now. Any suggestions?

If you are calling the recon line and a live rep is telling you that, then no.

I just called the reconsideration numbers given above. Both times I was told that the app was under review in the, whatever term the agent used, reconsideration department. I asked if there was someone I could talk to and was told no. I was pre-qualified per the Amex pre-qualification tool for the Green Charge card but then applied for the everyday card.

Was I being stone walled? Or is the submitting to the reconsideration department a legitimate process for possible approval. I don’t take it as a good sign that neither agent would talk to me about the reconsideration. It appears that other people have used these numbers to talk to an agent and get approved or declined directly.

Anyone with experience in this situation?

Thanks

Legit. Wait for them to contact you via phone or snail mail. It happens sometimes.

I applied and waited.. Nothing so I used the status link and it came back as address verification. I sent in what they asked for and wasnt good enough. Now they want a signed letter from my bank stating my address on a letterhead. Called my bank and they thought I was speaking a foreign language and had to talk to several people to finally get one in the next 3 weeks mailed to me..lol. Kicker…I already have a Delta gold with address. I was willing to pay 550 for platinum now with such bs I will do Chase. Exp 705 no neg.

Love how u delete post u dont agree with. Guess u getting paid by amex. I will let others know what u do.

What was deleted that I don’t agree with?

Well here I go for the first time I apply for amex green card and it’s still in progress can’t speak with anyone that talks English lol. I call to check status of app and the lady said it’s still in review now my Experian fico score is 776 no neg no inquiries and my credit history is 2 years 6 months wat could happen I wonder will they approve me because they had to send it back to reconsideration cause they told me they couldn’t pull a score up the first time so I wonder will they pull a hp now on my Experian to see my fico score my fico score Experian is 776 tu 756 eq 755 any suggestions for my first amex card

I’d give them a chance to pull your info. If you have a credit score and you gave them the correct info, they will find it.

Hi, I recently applied for the SPG card from AMEX. I applied through a phone call because I am not a US citizen therefore do not possess a SSN, though I have lived here for around 3 years already. My first credit card was from Bank of America and I have been using it for just about the same amount of time ive been here in the states, and the Fico score, which I can only view through my BOA app or website, indicate i have a credit score of 778. However, they never gave me a reply after I applied even though it’s been over 7 business days. I also called them once to clear things out, stating I have a stable income, I am currently a student here, but my income comes from overseas, and are transcated directly into my bank account. They said that because SSN holders have all the data linked to them in the database, they can sometimes come up with decisions instantly, however for people who apply using their passport, they need to look more into my credit history etc.

My question is, should I be concerned that they might not find the credit history linked to my BOA because it is actually a score provided by a bank and not through a SSN number? RN i am actually expecting them to phone me and tell me that they can’t find credit score or something. Its a FICO score, but I can only view it through my BOA account, neither can I apply for a credit score since as far as I know, every application requires me to fill out a SSN, which i don’t have.

Follow up with Amex until you get an answer. Let me know what you find out.

follow up? do u mean talking to a representative or calling the reconsideration line??

Yes

I called them about the status, they told me that my application is absolutely fine and going well, and they would answer to me within 48 business hours, which is around monday or tuesday since I called on friday, today is tuesday and its 19:42 west coast, I am guessing I won’t get an answer today?

perhaps they are mailing you a response if there is still nothing?

What’s AmEx Delta Reserve business card recon phone number?

Did you try the numbers above?

Got approved this morning, this is the 17th business day after i applied, but i must say, I am happy that wait was over, despite all the time when I anxiously opened my email to realize there was still no answer

congrats!

I was denied and called the recon line. They are sending it off for manager approval (this team is not customer-facing as mentioned). It’s under review…what are my odds of approval? I have a savings with AMEX. EQ 697, TU 700, EX 695…FICO 694

I was denied an AMEX Hilton Honors Aspire card. I called the “reconsideration” line, but was informed that customers do not get to speak directly with the credit analysts. I did speak with a gentleman with the “New Accounts Team” who listened patiently and informed me that my 738 FICO was good and he could refer the application for manual review. When did they stop allowing customers to speak with the analysts? Any chance the analyst will contact me during the reconsideration?

i would not expect a contact but i would definitely advise huca

I applied for an AMEX Blue Cash Preferred Card yesterday online. My application was denied. (From a credit monitoring service I use, I was notified that AMEX did a credit inquiry.) I am late-to-the-game regarding rewards cards–for years, I am 54, I have pretty much just stuck with the same old credit cards I have had for years. One of those cards did give me 1.25 points per dollar spent that, if you wait til you accrue 25,000 points, those points can be converted to a statement credit of 250.00: basically 1.25% cash back. However if you cash in your points before you have 25,000 points, the conversion would result in a smaller amount of dollars per points. But I digress. Within the last 30 days I have applied for, and have received, a Capital One Savor card and a Citi Double Cash card. As you may already know, Savor gives you 4% cash back at restaurants (not just 5 star sit down restaurants but 4% cash back, too, from places like Chipotle’s, Panera Bread, Starbucks, KFC, etc.). Double Cash card is 2% back on EVERYTHING. Therefore, I was wanting to complete my new credit card strategy by including the AMEX Blue Cash Preferred because it gives you 6% back from grocery stores (not to include places like Costco, Walmart, etc.) and 3% on gasoline/gas stations. Yes, the Blue Cash Preferred only rewards you 6% from grocery stores until you spend 6000.00 in any one year in that category, but I only spend about 3000.00 per year at grocery stores and so the 95.00 annual fee essentially pays for itself. In any case, I stumbled across the link to this site and decided to call the number. FYI: it is Saturday and I did speak to 2 live people. I pleaded by case and explained that the reasons given for denial may be obscured by the fact that I only just recently been granted 2 new credit cards. The 2nd guy, the guy I was referred to from the 1st guy, sort of cut me off (he probably was busy and essentially knew what I was asking) and said he would put my application through reconsideration and in 3 to 5 days I will be made aware of the outcome. As I told the guys on the call, it is not the end of the world and that I am still good regardless but, after discovering this AMEX “reconsideration” site, I thought, “…what the heck, ask for reconsideration…” I will hopefully remember to come back to this site soon and report back on the reconsideration decision.

PS: Thank you to the author of this site, regardless of the outcome of AMEX’s reconsideration.

Okay, I finally am back. After my call to the reconsideration line…I was still not approved. To tell you the truth, I was confused and even a little angry (my 5 year old self kicking in, I guess). So, today, August 11, less than 2 months later, I reapply for the same exact card. And I get the same message as before: that AMEX needs to review things. Well, whatever. Later in the day, I am checking email and, of course, I see the email from AMEX telling me that they have to review my card submission. The timestamp on that email was 10:53 AM. But I also have an email from AMEX at 10:59 AM. That later email says “Your American Express Application was Approved!”. The credit limit is for 6000.00. My case is probably not typical and I wouldn’t suggest you reapply ever 45 days to the same company for the same card but…well, I did. I can’t say I completely understand what exactly what went down but as I stated previously, I didn’t completely understand why I was rejected initially.

Thanks again to the author of this site/forum.

Peace to all.