Updated on December 14, 2023

In this post, I will share how I scored 200,000 American Express Membership Reward points (200k Amex) from 2 credit card signups – the Amex Business Platinum charge card for 150,000 points + the Premier Rewards Gold credit card for 50,000 points.

Fair warning before you read on: the Premier Rewards Gold offer is publicly available with very little effort involved whereas the Amex Business Platinum is targeted and requires luck / quite some effort if you are willing to try. For 200K Amex MR pts, I think it's worth the effort.

Amex Premier Rewards Gold Card (easy one)

You earn 50k bonus pts after $1,000 spend within the first 3 months. This is a publicly available offer – the only inconvenience is opening the application page in Chrome incognito mode until the superior 50k offer appears. Read the original post here (non-commissioned link for those curious)

Amex Business Platinum Charge Card (very tough one)

The charge card comes with a whopping $450 annual fee with the sign up bonus structure tiered as follows:

- Earn 100,000 bonus membership reward points after spending $10,000 within the first 3 months.

- Earn an additional 50,000 bonus points after spending another $10,000 within the first 3 months.

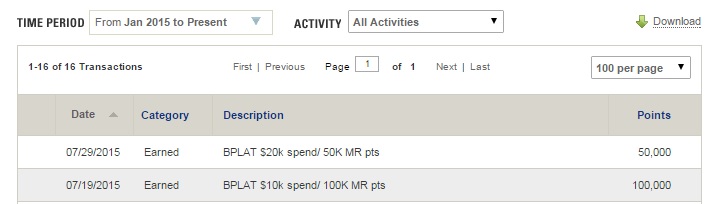

If you go for both bonuses, the literal translation: earn 150,000 bonus points after spending $20,000 within the first 3 months. Here's a screen print showing the full 150k posting as two separate line items (tiered):

Getting the 150K Amex Business Platinum Offer

I have tried all the tricks floating around the web to increase my chances of getting the higher offers but nothing seems to work. I changed my communication settings on all my Amex logins to give Amex permission to send whatever promotional materials they want and still got nothing. I even tried the Cardmatch tool once a week, every week, for 1 year and still nada!

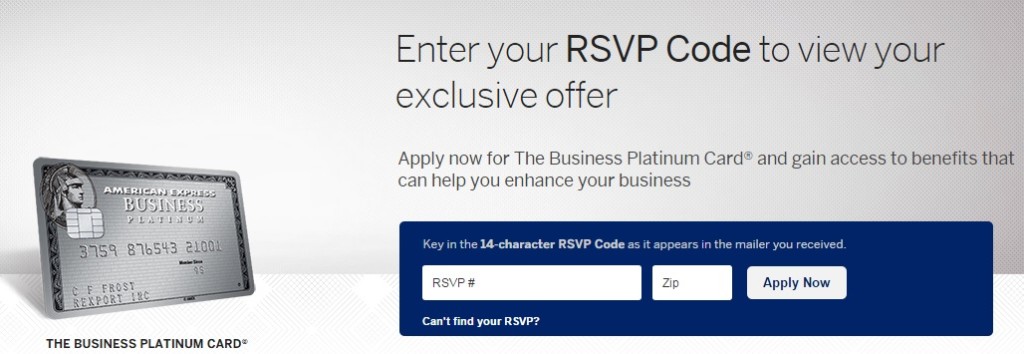

Just when I thought all hope was lost, I meet up a buddy of mine for happy hour one day and on the topic of credit cards, he tells me that he had received some “marketing junk mail” from Amex and was about to throw it away. I asked him to send me a picture when he got home and this is what it looked like:

Being the great friend that I was, I tried everything to sell him on signing up for this super-targeted Amex offer. Unfortunately, the high spend and $450 annual fee was too much of a burden, despite all the perks (such as the 2 x $200 annual airline fee credit) that would offset the annual fee. According to this FlyerTalk Wiki, it appears that anyone could sign up for the targeted offer as long as the RSVP code and the targeted member’s ZIP code matched:

The RSVP code is one time use and luckily, my friend had no issues with me using his targeted offer – what a monster score!

Fast forward a few weeks, I tell this story to another friend of mine. That week, while checking his mail one night, he noticed that the building’s mail trash bin (where residents conveniently throw away all the junk mail in the mail room) had the same offer targeted for one of his neighbors. He rang the doorbell of his neighbor and asked for permission before using the offer… a monster score for my friend!

Summary

If you live in a condo or co-op that has a communal mail trash bin, be on the lookout for these targeted offers that your neighbors may consider “marketing junk mail” from Amex. I am not necessarily advising everyone to rummage through the bin, but perhaps keep your eyes peeled.

If your building has a porter, it might not be a bad idea to offer him some sort of cash reward for him to browse through the junk mail daily before throwing away in the chute. You may also want to tell your family members to be on the lookout for such targeted offers (show pic above), especially if they don't have an appetite for the $450 annual fee.

Finally, even though it hasn't worked out well for me, be sure to turn on your Amex communication settings and periodically check the Cardmatch tool to see if there are new offers for you. Good luck!

Uses / Related

One of my favorite Membership Rewards transfer partners is BA Avios at a 1:1 transfer ratio. There are occasionally transfer bonuses from Amex MR to BA, but I am anxiously hoping for one before the October 2015 devaluation from 1:1 to 1:0.8. Check out my Aer Lingus NEW Business Class review – business class seats attainable for 40k BA Avios pts one-way per person.

If you decide to sign up for the Premier Rewards Gold card, you may also want to consider adding one of the several Citi AA cards as part of your mini-app-o-rama.

Asking someone (let alone yourself) to sort through mail in a recycle bin looking for unopened credit card applications is a very, very bad idea and could bring about federal legal action.

really? http://www.duhaime.org/LawMag/LawArticle-1390/Trash-Can-Law-Finders-Keepers-Losers-Weepers.aspx

“There is a widely held and long-standing doctrine that personalty discarded as waste is considered abandoned. Abandoned property is property the owner has thrown away. The abandonment of property is the relinquishment of all title, possession or claim to or of it – a virtual intentional throwing away of it. Property is said to be abandoned when it is thrown away.”

The suggested way to asking neighbor or porter for mail is really a shame. Please don’t provide such a bad advice to your reader.

Jay – You sound like someone who redeems miles for domestic coach. If you want something bad enough you willing to go the distance. 150k MR from 1 signup is the highest bonus seen.

@Jay

Guess what I’ll be doing tonight! Dumpster diving baby!

The premier gold is a charge card, not a credit card.

Thanks for the correction – updated.

so how do you manufacture $20k spend in 3 months? that’s the real question.

College tuition for family members… I try not to MS whenever possible