Updated on December 14, 2023

Cash is King, Right?

Savvy consumers knows that credit is king (not cash), especially in the US. I wake up each morning thankful that I live in the States and am eligible for the massive signup bonuses that credit card issuers release only in the US market. Find yourself living in another country and you will wish you had a US-based address with good US-credit.

Examples of Big Sign-up Bonuses

Check out my Top 5 List I published in earlier this month – what I consider to be the best credit card signups for the month. Shortly after publishing, the 50k Amex PRG Offer was resurrected again. And of course, my all-time favorite for getting 3 free first class one-way domestic flights on United: Barclays Lufthansa Miles & More 50k Signup. I recently applied again after having cancelled the same card 8 months ago and Barclays approved my application / confirmed the 50k signup bonus.

Be on the lookout this upcoming week for my Top 5 List for August.

Credit Card Application Strategies

Aggressive – The App-o-rama is an extremely popular strategy for scoring the most points and miles in the shortest amount of time. It makes sense – apply for credit cards across different issuers all on the same day so each bank does not see the hard pull / new account opening until the next day (or few days). Once the credit bureaus see the hard hits / new accounts kicking in, the credit scores plummet temporarily. Someone going for this strategy may only do App-o-ramas 3x a year, leaving enough time lapse for the credit score to jump back up before performing another App-o-rama.

Conservative – On the other end of the spectrum, you have the conservative consumers who may only apply for a few credit cards each year. In their eyes, they don’t want to deal with the hassle of managing “so many” cards or remembering to cancel 1 year later for those with annual fees. See related: Credit Cards Worth Paying the Annual Fee

Just Right – The strategy that works best for me is the mini-App-o-rama. Instead of banging in 7+ credit card applications in 1 day, I sometimes apply for 3-4 on the same day. My rationale is that each card has a minimum spend that’s required to earn the signup bonus (typically $1,000 – $10,000 spend within first 3 months, depending on the offer) which I can handle within a 3 month period.

Occasionally, I fall short on the minimum spend requirement and use manufactured spending strategies. Sometimes there are fees to do this like a 3% transaction fee but $30 – $60 is a small fee to pay for tens of thousands of bonus points/miles.

Where Do Credit Scores Come into Play?

Credit is the most important factor for credit card approvals. Currently, there are 3 credit bureaus: Equifax, Experian, TransUnion. Each bureau issues its own FICO score which ranges up to 850. Prime, in credit score terms, is considered 740+. That means that creditors will generally offer the best (lowest) rates if your median credit score is above 740. There are exceptions, such as HSBC, who will offer prime rates on Premier Deluxe Mortgage packages with a median score of 760+.

Free Credit Scores for All 3 Credit Bureaus – Equifax, Experian, TransUnion

There are a handful of sites that offer free credit scores and I only recommend the 2 sites below. Between these two sites, you will be able to see your credit score across all 3 credit bureaus:

- CreditKarma – provides free scores for TransUnion and Equifax, updates scores once every 7 days. Provides virtual TransUnion and Equifax credit reports (not just score) showing the main factors that impact your score.

- Credit.com – provides free credit score for Experian, updates score once every 30 days. Provides a virtual Experian credit report (not just score) showing the main factors that impact your score.

Generally speaking, Equifax and Experian are pulled the most by card issuers, with TransUnion being the C-class prostitute that most ignore. Looking at my history, Barclays is the only bank that has performed hard pulls on my TransUnion report, although this differs by bank and by state. Capital One is the only bank that will pull all 3 credit bureaus.

If you find an error on any of your virtual credit reports, you will need to correct the error directly with the credit bureaus. The best way is to request your free annual credit reports for all 3 bureaus. Once each credit report is generated, there will be options for you to dispute inaccuracies.

Using CreditKarma and Credit.com before Applying for Credit Cards

My approach – right before a mini-App-o-rama, I refresh my credit scores on CreditKarma and Credit.com. Although not necessary, I make sure that all 3 scores are 740+ to have the best chances of approval. I also check the virtual credit reports to get a sense which bank pulls from which credit bureau. In my case, I almost always include a Barclays-issued credit card, since no other banks pull from my TransUnion report.

To date, I have only been denied 1 credit card – the Chase Ink Plus in late 2013. I eventually got the card several months later but my original rejection was due to “too many new accounts in past 12 month period” of which 2 were new Chase accounts. No one likes rejection and for that reason, I only include Chase in every other mini-App-o-rama.

How Accurate Are the CreditKarma and Credit.com Scores?

I generally find the scores produced by CreditKarma and Credit.com to be fairly accurate +/- 10pts. So far, my true FICO scores ends up being higher than what's reported on CreditKarma and Credit.com. This is good since I usually target 740+ and would much rather be positively surprised than to hear from my mortgage broker that I didn't qualify for the prime rate on my refi.

As a reference, I have closed / refinanced my home a total of 4x within the past 2 years – each event required a hard pull from all 3 credit bureaus and I was able to compare the scores produced by CreditKarma and Credit.com vs. my true FICO scores as reported by Equifax, Experian, and TransUnion.

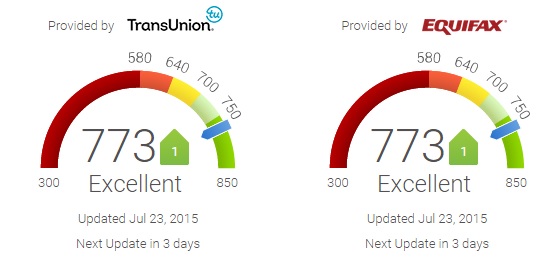

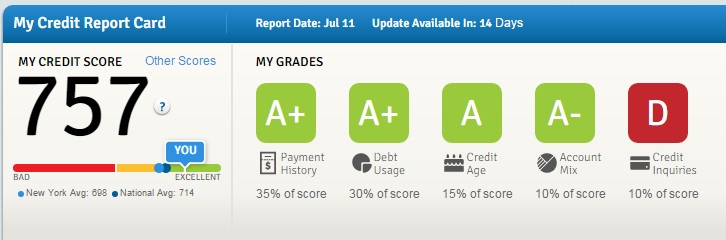

What Cards Did I Apply for Recently and How Do My Credit Scores Look Now

My most recent mini-App-o-rama occurred last week and included the Barclays Lufthansa Miles & More 50k Signup, Amex Delta Biz 60k Signup, and the Citi AA Personal MasterCard. My credit scores today: 773 (TransUnion & Equifax) and 757 (Experian):

While the hard hits generally decrease credit scores, the new accounts increase my total line of credit, reducing my credit utilization and ultimately increasing my credit score. It doesn't always work this way: the law of diminishing returns eventually kicks in when your credit line is high enough where the positive effect of another $10,000 in new credit is not enough to offset the negative effect of the hard hits / new accounts in a short amount of period.

For those keeping track, yes, these credit scores reflect:

- 4 hard hits from my mortgage broker in the past 2 years of which 2 are within the past year – all 3 credit bureaus were pulled each time

- 6 mini-App-o-ramas in the past 2 years of which 3 are within the past year (and 1 last week) – credit bureau pulled determined by bank and state of applicant

Final Thoughts

Feel free to share in the comments below:

- Do you also refresh CreditKarma and Credit.com right before applying for credit cards?

- Are you more conservative, aggressive, or somewhere in the middle when it comes to credit card applications?

- Are there any other free credit score sites that you prefer over CreditKarma and Credit.com?

Contrary to what you posted in the title, these are NOT FICO scores. You allude to it in your post, but being 10 +/- is not true, they can be off by 50-100 points, and occasionally more.

Was happy to see a new blog on BoardingArea, horribly disappointed that you feel the need to lie in your titles to get more page views (I’m assuming you are lying rather than being misinformed as you clearly explain in the body of the post that these are not actual FICO credit scores).

The exact verbiage states “I generally find the scores produced by CreditKarma and Credit.com to be fairly accurate +/- 10pts.”

I interpret that as “in my experience” and not something that’s set in stone.

Ben – agreed these are not FICO scores and “FICO” has been removed from the title. For the record, it wasn’t my intention to lie; this was a clear oversight. Thanks for the feedback.

Provide some data points where scores differed vs the true score by a whopping 50 pts. That would be shocking and completely useless for the consumers.

Read this thread:

https://creditboards.com/forums/index.php?showtopic=546262&hl=%20credit%20%20karma

And this one:

https://creditboards.com/forums/index.php?showtopic=542787&hl=+credit%20+karma

For plenty of examples. There’s a lot of BS on page 1 of that second thread, but on Page 2 you’ll see a few more examples.

I’m not making it up — mine is off on both Equifax and Transunion by more than 100 points from a true FICO 08. Do some Googling. You’ll find that the “FAKO” scores are useless for most people, Believe me — I’ve spent more hours than you can imagine researching credit to play the game at the highest level. While the CK score might just happen to be accurate for some folks, it’s not the norm. It’s not even the same scale — the Vantage scale is on a scale of 900. FICO 08 scores only go up to 850. It’s a totally different algorithm.

My actual scores were very close to what I found on CreditKarma and Credit.com as well as some others I used. Not sure why you would say 50-100 points. The services would be pretty useless if they were that far off. Which site was off that much for you?

Yea, Had similar experience – few points difference now and there but not a big 100s

I would have to agree that YMMV on the +/- 10 points as my Credit Karma/Sesame were both showing 785-792 and when I bought my new car, my Transunion came in at 837.

As I mentioned below, there are several different kinds of scores. The form of Transunion score that an auto lender uses is different from the score used by a credit card company. The fact that these were similar is a coincidence.

As of the other day, my Credit Karma Equifax score was off by 143 points. My Trans Union score was off by 108. Those are comparison to my true FICO 08 scores. Of course, your post neglects the fact that there are many different kinds of scores — though most credit card lenders use FICO 08. Of course, Capital One uses FICO 04 — which, for most consumers, would be a lower score as the scale doesn’t go all the way up to 850 (but rather stops at 839). Of course, mortgage underwriters typically only use FICO 04. Nobody — let me repeat, NOBODY — uses the fake scores provided by Credit Karma, Credit Sesame, and the like. While those scores MAY be +/-10 from your real score, so might the number of calories I ate for lunch. Those services are useful for getting a feel for which day of the month your issuers report your balances and anything negative that may appear on your report. There are free sources of real scores — for example, Discover, Barlcays, and Walmart all provide a monthly Transunion FICO 08. Some credit unions provide a monthly Equifax 04. You can buy a score for a $1 trial from Experian. You can also buy scores from MyFICO. But you have to know which product you’re looking for — everyone and their mother will try to sell you a fake score. I recommend doing some research rather than relying on what is generally known as a FAKO score.

Just like LeVar Burton told you as a kid — you don’t have to take my word for it. Go do some reading on a reputable credit forum like Creditboards.com You’ll find out more about both how to maximize your score and how useless CreditKarma-type FAKO scores are. And they’re not selling you anything.

Chase and App-o-rama in one sentence is dangerous for people not familiar with Chase’s new requirements.. You’ll get denied for Chase (UR earning) card if you had 4+ Credit Card Apps during past 2 years. Even being an AU on somebody else’s card counts toward that number

Agreed. 5+ new cc accounts (across all banks) in the past 2 years will lead to rejection on Chase cards that earn UR pts. Rule does not apply for all other Chase cards.

My actual scores were very close to what I found on CreditKarma and Credit.com as well as some others I used. Not sure why you would say 50-100 points. The services would be pretty useless if they were that far off. Which site was off that much for you?