Updated on February 19, 2016

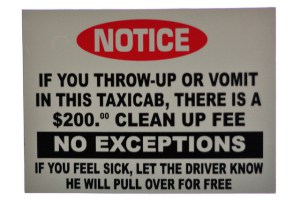

Do Annual Fees Make You Want To Vomit?

I often get asked by friends whether they should keep or cancel certain credit cards when the annual fee hits. I hate annual fees, but in some cases, the card is really worth the fee. Below is my own list of credit cards with annual fees that I keep. It’s been almost a year and a half since I last posted about this, yet the list has not changed much.

Which card do you keep and pay the annual fee? Let me know in the comments below.

Chase Hyatt Visa

- Current Sign-Up Offer: 2 free nights at any Hyatt in the world after $1,000 spend on purchases in the first 3 months of account opening PLUS $50 statement credit. Check out all the Park Hyatt locations and take your pick. Best bangs for the buck for the 2 free nights: Park Hyatt Tokyo, Park Hyatt Maldives, and Park Hyatt Paris Vendome.

- Links to Sign up: Courtesy of Doctor of Credit

- Annual Fee: $75, waived the first year.

- Annual Perk: 1 free night at any Hyatt hotel in categories 1 – 4. Toggle the dropdown in this link to see what Hyatts are available in each category. As long as you are able to redeem the 1 free night at a Hyatt that costs more than $75, you are ahead of the game.

- Other Perks:

- Chase offered special targeted spend bonuses last year

- Visa Signature RSVP events such as this one

- No Foreign transaction fees

- Hyatt points do not expire so long as you have credit card activity

- Automatic Hyatt Platinum Status

- Wish List – It would be great if…

- The 1 free night was unrestricted in category or at the minimum, expanded to cover category 5

- Automatic Diamond status could be attained through annual spend ($75k spend for example) – this might actually come true

- Normal spend earned 10pts per $ instead of the current 1pt per dollar. With most of the Park Hyatts hovering between 25-30k / night, it only makes sense to keep the card open, but put spend on the SPG Amex Personal and Small Business cards – exception would be international spend where there are no FX fees on the Chase Hyatt.

SPG Amex Personal and Small Business

- Current Sign-Up Offer: Earn 10,000 Starpoints after your first purchase on the Card and an additional 15,000 Starpoints after you use your new Card to make $5,000 in purchases within the first 6 months.

- Links to Sign up:

- Direct link to SPG Amex Personal Card

- Direct link to SPG Amex Small Business Card

- Referral link to SPG Amex Personal Card (same offer but I get paid a referral bonus if you sign up using my link. Thank you if you use this link -> then click “Airline & Frequent Flyer Credit Card Offers”)

- Referral link to SPG Amex Small Business Card (same offer but I get paid a referral bonus if you sign up using my link. Thank you if you use this link!)

- Annual Fee: $65, waived the first year.

- Annual Perk: Receive 2 stays / 5 nights credit towards SPG Platinum elite status. SPG Platinum status requires either 25 stays or 50 nights per calendar year. Sign up for both the personal and small business cards and receive 4 stays / 10 nights credit. I only recommend paying for the annual fee if you (like me) need the credits to requalify for SPG Platinum and benefit from earning Starwood points (my favorite hotel program)

- Other Perks:

- SPG pts do not expire so long as you have credit card activity

- SPG Gold status – Earn SPG Gold status after spending $30,000 or more in eligible purchases on the Card in a calendar year. SPG Gold status comes with a 50% point bonus, upgrade to best available room, at check-in, and 4 p.m. late checkout, when available. The 30k spend required for Gold status is high and if you are going to spend that much, you are better off signing up for a different credit card bonus.

- Wish List – It would be great if…

- There were no foreign transaction fees. I stay at SPG properties internationally and it doesn’t make sense for me to use the SPG Amex card to pay for the stay because of the ~3% FX fee.

- There were additional stay/night credits through annual spend

- Cardholders received an annual free night, similar to the Chase Hyatt and the Chase IHG

Chase IHG MasterCard

- Current Sign-Up Offer: 70,000 bonus pts after $1,000 spend on purchases in the first 3 months of account opening.

- Links to Sign up:

- Direct link

- Referral link (I get paid a referral fee if you sign up using my link. Thank you if you use this link -> then click “Airline & Frequent Flyer Credit Card Offers”)

- Annual Fee: $49, waived the first year.

- Annual Perk: 1 free night at any IHG hotel. Check out all the Intercontinental hotels and take your pick. Best bang for the buck for the annual free night: Intercontinental Bora Bora

- Other Perks:

- No foreign transaction fees

- IHG pts do not expire so long as you have credit card activity

- Automatic IHG Platinum Status

- Wish List – It would be great if…

- IHG Platinum status was more valuable – it’s currently the top tier but offers few benefits

- Normal spend earned 10pts per $ instead of the current 1pt per dollar. With many decent IHG hotels hovering around 50k / night, it only makes sense to keep the card open, but put spend on the SPG Amex Personal and Small Business (see above).

Citi Hilton HHonors Reserve Visa

- Current Sign-Up Offer: 2 free weekend nights at any Hilton in the world after making $2,500 in purchases within the first 4 months of account opening. Weekend nights are defined as Friday, Saturday, and Sunday nights.

- Links to Sign up:

- Direct link to Citi Hilton HHonors Reserve Visa offer

- Annual Fee: $95, not waived the first year. Check out all the Conrad locations and take your pick. Best bangs for the buck for the 2 free weekend nights: Conrad Maldives and Conrad Koh Samui

- Annual Perk: 1 free night at any Hilton, limited to weekend nights only, after $10,000 spend during the previous card-member year. Weekend nights are defined as Friday, Saturday, and Sunday nights.

- Other Perks:

- No foreign transaction fees

- Hilton points do not expire so long as you have credit card activity

- Automatic Hilton Gold Status – as Lucky points out, this is a huge perk vs. the top tier Diamond level

- Wish List – It would be great if…

- Normal spend earned 10pts per $ instead of the current 3pt per dollar. With recent devaluations, Hilton award redemptions may hit 95k / night (Conrad Koh Samui). It only makes sense to hit the $10,000 spend requirement for the annual free weekend night, but put all additional spend on the SPG Amex Personal and Small Business. Some argue even the $10,000 spend on this card is not worth it and I see their point: $10,000 spend yields either 30k Hilton pts or 10k SPG pts. 30k Hilton pts barely gets a free night at a budget Hilton hotel, whereas 10k SPG pts will get any category 4 hotel, which in my experience are usually 5-star.

Other Considerations:

- Amex Platinum Personal / Business – some argue that the $200 airline credit offsets the card's hefty $450 annual fee and that $250 is worth Delta lounge access (cardholder only) and Centurion lounge access (cardholder + 2 guests). Other than a 75k+ signup bonus further justifying the annual fee, this card is not a keeper for me. With Amex terms updated that allow signup bonuses after a 12 month period, not sure why one wouldn’t alternate between the Personal and Business versions. And since the $200 airline credit is per calendar year, all members can get $400 worth of statement credits in a 12 month period.

- Chase Ink Plus – $95 annual fee. For those who have large telecommunications and office supply bills/spending, this may be a card worth holding on to. With the 5x category bonus on office supply stores and on cellular phone, landline, internet and cable TV services (up to $50,000 annually), you have the potential to earn a lot of extra (5x bonus) Chase Ultimate Rewad. Note that I am still within my first year of holding the Ink Plus. When the annual fee hits for year 2, I will have to make the decision then. For now, I am thinking that…. IT’S A KEEPER!

Note: If you click some links on this site, TheRewardBoss may receive a commission at no added cost to you. By doing so, you help support my project and allow me to continue providing you with more rewarding information. I research, travel, and write my opinions regardless of whether there is a commission available. You don’t have to use my links, but I appreciate when you do. Thank you for your support!

Want to see how I earn enough points and miles to travel for free? Read this first. Be one of the 10s of 10s of people who subscribe to receive email updates whenever I post a new article. Enter your email address in the top left corner of the site and that’s it. Cancel anytime. Follow me on Facebook, Twitter, Google+, or RSS feed.

your thoughts on chase sapphire preferred?

Not a keeper. Lucky did a compare vs. Citi TY Preferred here: http://onemileatatime.boardingarea.com/2015/02/24/chase-sapphire-preferred-vs-citi-thankyou-premier-card-which-is-better/

The main draw is the flexibility of Chase’s UR pts, which is attainable via the Chase Ink Plus. Chase Sapphire used to have 7% dividends (which might have been reason to keep) but now dead for 2015.

Ditch the Sapphire… go for Ink Plus instead.

What about Chase Marriott? Free night there as well?

Also US BANK’s Club Carlson…

To a lesser degree, southwest; as the points there pretty much negate the AF.

Regarding the Chase Marriott card, it doesn’t come with any automatic status (e.g. Plat w Chase or Gold w Citi Hilton), so while Chase offers 1 free night at any cat 1-4 Marriott annually, it’s slightly under my bar for approval. If you have Gold or Plat status with Marriott to begin with, you may want to consider keeping the card as it also comes with: 15 CREDITS TOWARD ELITE STATUS

Similar to my reason for keeping the SPG Amex cards, this may help you requalify for Gold/Plat with Marriott. One final note: As Mommy Points notes here, Marriott plans to undergo another round of annual “adjustments” http://mommypoints.boardingarea.com/2015/02/26/2015-marriott-award-chart-changes/

The Club Carlson Premier Rewards Card never crossed my mind – in all my years of travel, my preference would be focused on SPG and Hyatt (and Hilton before multi year devaluations). If your future travel destinations have Club Carlson properties available, Lucky gives thumbs up: http://onemileatatime.boardingarea.com/2013/06/24/club-carlson-premier-rewards-visa-signature-card-how-valuable-is-it/

I just paid my 2nd year fee on Club Carlson. It gives you 40 k points, worth 2 nights at most of their hotels (except the 50k category and a handful of 70k). Second night free on all reservations. We’ve used the points in Iceland, and will use in Paris and Aruba soon. Great value. And I just stayed at a Country Inn to get a huge 25k point bonus; it wasn’t bad.

15N = Silver …

I dont consider Marriott Silver as real status (haha), but technically you are correct, still better than no status. As little value as Hyatt Platinum gets, there is potential for room upgrades, which Marriott Silver does not.

How about Fairmont? Smaller footprint, but similar annual perk to Hilton