Updated on February 19, 2016

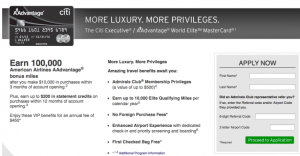

The Citi Exec AA 100k Bonus + $200 Statement Credit is Still Alive!

UPDATE: 7/11/14- it appears this offer is dead. Read more details here.

I have been refreshing this Citi AA 100K Flyertalk thread constantly since Tuesday night, when it was first rumored that the 100k / $200 statement credit offer was going to expire. Hoping for the best (that it wasn’t true) but expecting the worst (that it was true), I applied for my 3rd Citi AA at 8PM Tuesday night and was instantly approved with a CL of $22,000. The frequent flyer community learned the following morning that while the official landing page no longer loaded, the direct application link remained alive, although it did not state the 100k / $200 statement credit sign up bonus. Brave souls in this Citi AA 100K Flyertalk thread decided to apply anyway and those who called in to Citi confirmed with the rep that the offer was indeed 100k after $10k spend in 3 months and $200 statement credit after first purchase. The Wiki on the flyertalk now states:

We do not know, and Citi has not indicated, how long these offers will last. Citi has left other offers alive for over a year beyond the ‘apply by' date in the past. These links could be here all year or gone tomorrow. If the application loads, it is, based on past Citi applications that survived past the landing page expiration, good. Regardless of any posted or advertised ‘apply by' date. If the lack of a landing page is a concern to you, try the 75K landing page.

With this in mind, I informed all my close colleagues, friends, and family members that they should apply while the ghost link was still alive – no guarantees when Citi IT will take this down. As mentioned in the last Weekend Update, I followed up with my colleague who planned to earn 1 million AA miles for $810 to get his thoughts. My colleague noted that it was quite a scare when he learned the offer died Tuesday night, but was pleasantly surprised to learn that the ghost link was still alive. I have received many inquiries asking for details on the goal to 1 million AA miles for $810. I interviewed him to find out more about his plan.

Note: I DO NOT RECOMMEND DOING THIS. While everything he is doing appear legal, there might be some ethical issues and I also wonder if there will be some tax implications at the end of the year (i.e. will you get a 1099 tax form at the end of the year?).

I caught up with Mr. 1 Million Miles and asked about his plan to get 1 million AA miles. Here's what he said:

- Mid Jan 2014 – He applied for the first Citi Exec AA card with credit line (CL) of $22k, paid annual fee (AF), met the $10k spend mid March, and the card is still active. Net cost for first set of 110k AA miles: $250 ($450 AF less $200 statement credit). The Plan: keep card for 1 year since AF was paid.

- Early March 2014 – rumors on this Citi AA 100K Flyertalk thread that the AF is fully refundable so long as the card account is cancelled within 37 days from the date the AF was billed, typically on the same date the first statement was generated. Unlike other banks, Citi terms did not have claw back clauses for bonus pts. Planning for the next card, he sent secure message to Citi requesting decrease of credit line to $5k (minimum allowed for this card), in order to free up credit.

- Mid March 2014 – He applied for the 2nd Citi Exec AA card with CL of $19K, met $10k spend within 10 days, first statement closed with AF charged, confirmed 110k AA miles deposited into his AA account.

- How did he meet the spend? He used several spend techniques discussed here. Net cost: $174

- Late March 2014 – He sent secure message to Citi requesting decrease of credit line to $5k (minimum allowed for this card), in order to free up credit. He then cancelled his 2nd Citi Exec AA card the next day. AF refunded, 110k AA miles and $200 statement credit remained. Net cost for 2nd set of 110k AA miles: $174 minutes $200 statement credit = Citi paid him $16 and gave him 110k AA miles.

- He repeated the cycle above until the ghost link dies, keeping in mind the unofficial 8/65 day rule with Citi applications – i.e. no more than 2 Citi applications within 8 day period and no more than 3 Citi applications within 65 day period.

- If the ghost link lasts a full year, he plans to keep the card that he applied for in January 2015. He feels as though $250 is a small fee to pay for AA lounge membership for 1 year.

This is quite the ambitious plan. The idea of having 1 million miles is very tempting but this seems to be abusing the terms and conditions which surely were not intended for such loopholes. Then again there was always quite a debate on if its ethical to take advantage of a fare mistake and at what points is it considered a fare mistake and not just a really good price. I have 1 Citi Exec AA card and will be keeping it at least for a year.

What do you think?

- Is it unethical to cancel the account within 37 days just to get the annual fee refunded?

- Does anyone expect to receive a big 1099 tax form from Citibank for all these miles?

- Is the plan to get 1 million miles crazy? Do you plan to follow his footsteps?

10s of 10s. Love it.

I am a bit concerned there are done unforeseen consequences of how some people have been abusing this offer.

🙂 Same here. Maybe a hefty tax bill? Only time will tell.

Dude has too much free time. I like how he is beating corporate big banks, but dislike how his actions, as well as others doing similar spends, will likely cause devaluations. I work my ass off and dont have time fir this kind of stuff.

Would think this is relative to what each person does for a living. If the guy is earning min. wage and can earn 110k aa miles every month, well he just increased his monthly pay by at least $5,000 (I’m thinking rd trip business class cathay to Asia).

Looks like you are in a different league Perlneck – congrats and keep bringing home the millions.

Your comments don’t make sense Phil. You can do a hell of a lot more than roundtrip Cathay J to Asia, with 1mil miles. I think Perl has a valid point. We can expect continued huge devaluations -if the minimum wage dude(s) with shtiloads of freetime continues.

I think he meant with 110k miles — getting the card once and doing the spend. Citi is paying for those miles so I’m not sure if that will directly cause devaluations but may you are right.