Updated on January 11, 2019

Citi Application Status and Reconsideration Phone Line

If you applied for a Citi credit card and did not get instantly approved, it doesn’t mean you were denied. You can easily check the status of your application. If you were denied, the Citi reconsideration department can reverse the denial over the phone!

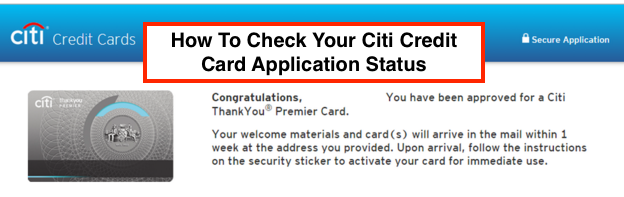

How to Check Your Citibank Credit Card Application Status

Similar to Bank of America and Amex, you can check your Citi application status online.

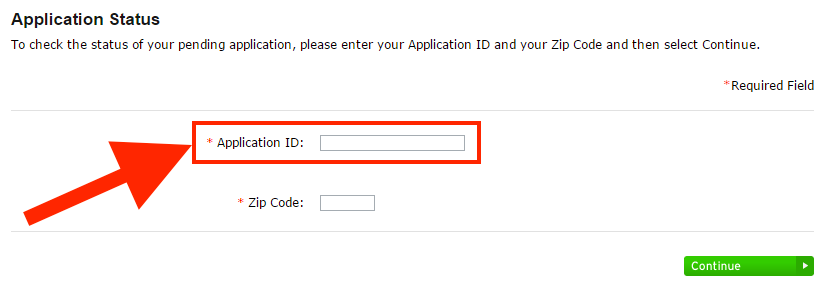

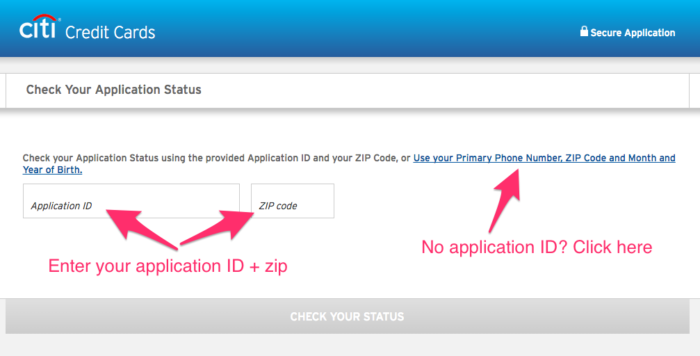

Citi now has 2 application status check sites. One requires the APP ID (which you may have to call and ask for) while the second has an option to search by phone number, zip code, and birth date.

Links

- Citi Application Status (1) (requires application ID)

- Citi Application Status (2) (search by application ID or your Primary Phone Number, ZIP Code, and Month and Year of Birth).

NOTE: Searching by application ID worked for me on both links. Searching by phone number, zip, and birth day on the second site did not work for me.

Steps

- Click here: Citi Application Status (1) or Citi Application Status (2)

- Enter your application ID and ZIP code and click “CHECK YOUR STATUS”. If you don't have your application ID, click the link to “Use your Primary Phone Number, ZIP Code, and Month and Year of Birth”.

Citi Reconsideration Phone Line / Number for Denied or Pending Applications

If your online credit card application went to pending decision without an application ID or was straight-out rejected, your next best move is to call the Citi reconsideration phone line. Even if the application is pending, there is still no downside to calling as you will be speaking with live credit analysts who have the power to approve your pending application or reverse your denial over the phone.

There are quite a few phone numbers to call. Here are the ones I found to have the most direct method to reach a live rep and also numbers that yield the most promising results:

- Personal Cards: Call 800-695-5171, 888-201-4523, or 866-606-2787

- Business Cards: Call 866-541-7657

What to Say to Citi Credit Analysts

Keep in mind that the Citi credit analysts have approval power, so you want to be soft-toned and as helpful as possible. If you are unsure of what to expect during these calls, here is an example:

- Citi Credit Analyst: My name is Mary. How may I help you?

- Me: Hello Mary, how’s your day going so far?

- Citi Credit Analyst: It’s going fine; thanks for asking (or some similar variation… if the small talk continues, just go with the flow). How may I help you?

- Me: I recently applied for a credit card online and I am surprised I didn’t get instant approval. I wanted to see if I could help answer any questions in efforts to facilitate the approval process.

- Citi Credit Analyst: I would be happy to have a look. Do you have an Application ID?

- Me: (Provide if you have one. If not: say this) I do not have one – are you able to look it up by social security number?

- Citi Credit Analyst: Yes – may I have your social security number?

- Me: (Provide your social)

- Citi Credit Analyst: Please hold 2-5 minutes while I look up your application.

- Me: No problem – take your time. I am in no rush.

Often times, the credit analyst gets off hold and tells me I am approved without any additional verification. When asked why I didn't get instant approval, the replies I have received varied, but generally along the lines of spelling of “street” instead of “st” or some other formatting that the Citi system didn't like on the application.

Unlike Chase and Bank of America, I find Citi and Amex to be the most lenient in approvals with Citi taking the throne. To date, I have been rejected only once by Citi. It was for the Citi AA Business credit card and the rejection was solely driven because I did not follow my own guidelines on when to reapply for signup bonuses.

Citi Credit Analysts for Business Credit Cards

Citi business credit cards are equally as easy to get approved over the phone. Remember, you can apply for business credit cards legitimately, even if you do not own your own business. Citi reps know this and will make the decision based on your personal credit report.

The “8/65” Rule

If you have not applied for a Citi credit card yet, it is very important you are familiar with the 8/65 rule. Simply put: No more than 1 Citi credit card application within an 8 day period and no more than 2 Citi credit card applications within a 65 day period. If you break this rule, you will be rejected and all the tips in the world will not get the denial reversed.

Other Tips – For Those with Negative Remarks on Credit Report

If you know of any negative remarks on your credit report ahead of time, be prepared to speak to it. Whatever the reason for the negative remarks, be prepared to explain it in a way where the credit analyst can sympathize with you. The most important part is to stress that it was a one-off event, and that it will never happen again! I repeat these words of caution often: If you cannot pay your credit card bills in full every month you should not be collecting points through credit card bonuses as you may end up deep in debt. A free trip may help you feel better but it's not worth falling into debt for!

Finally, if the credit analyst still isn't sold, try asking for the minimum credit line allowed for that particular credit card, or, if you have existing credit cards with Citi, request transferring existing credit so that you can get approved for the new credit card (without increasing total exposure).

See my post on Chase Application Status Check + Tips on Reconsideration Phone Line / Number to see additional tips on owning your calls with credit analysts.

RewardBoss Citi Credit Card Picks

See this page for the most recent credit card offers.

Another tip. Citi really hates inquires and I mean really hates them. I recently was instantly denied for the Citi Premier due to “too many recent inquires”. I had a 2 from credit cards and 6 from a recent house purchase. After three calls to the recon lines and two different supervisors they were all unable to “override the computer”. They were very unhelpful and it was a very different call than Amex/Chase. They keep insisting that I dispute the inquires with the credit bureaus. That is the stupidest thing I have ever heard.

I was approved after writing a letter to their executive review team… Honestly, I don’t even want the card anymore after the debacle of getting approved.

I suspect there is more to the rejection than just too many inquiries in past 12 months. I have had 16 new cc accounts in 2015 and continue to have no issues getting approved for citi cards.

Citi is strange. They told me that I exceed 6 inquiries in the last six months (which is true, but a majority of them were mtg which they didn’t seem to care). Anyway, I was just instantly approved for the Citi AAdvantage World MC. I’m starting to think that Citi is similar to Chase’s new rules, meaning that they are more sensitive for their TY products / double cash than their cobranded cards. Just a thought.

Been rejected multiple times. Stopped calling the Citi recon line after the headache. Written letters now and get approved that way. 3x.

Only Barclay is more annoying on the recon. Of course Chase is/was the best via phone until the new rules.

thanks – i am in the same shoe as you. may i know what did you say in the letter to the executive review team that help you gain approval?

is this something that needs to be done by snail mail to “CitiBank Executive Review Department P.O. Box 6000 Sioux Falls, SD 57117”?

I applied today online, I got the email saying application needs more review. I called a few hours later and was approved for $5,400.

What is the re-consideration mailing address?

Tom – This is the address that I wrote to. They approved the account about a week and a half later. Citi’s recon line is useless.

CitiBank Executive Review Department P.O. Box 6000 Sioux Falls, SD 57117

I apply for a citi advantage card and was approved instantly, but didnt get the card after 8th days of being approved, i was approved on a Saturday but didnt get no card on the other Saturday

Don’t know why Citi is so slow, but this is normal. My card usually takes 1-2 weeks before arriving. No need to worry until 2nd week passes.

How easy is it to get a secured card from them? I’m still waiting on a response and for them to debit my account for the deposit of funds.

I don’t think it would be too hard considering its a secured card, but I haven’t done this myself. How long are you waiting?

Thank you sir, your info was spot on!

I applied for a citi bank c/c and was not approved instantly, however I used you tip to call the next day! I did exactly what you said word for word! I gave her the application I d ! She said may I place you on hold for two to five minutes! In less than one minute she ask me for my cellular number approved card! The problem I left of my suite number! That like you said caused the computer to kick it over to a credit analyst! Thank you

Bought a car a Citi declined for to many inquiries even though they had nothing to do with credit cards. Stay away from Citi!!! They’ll decline you if you have inquiries regardless where the inquiries initiated. Poor business decisions! I see the powers that be love to say ‘NO”!

Was declined due to having to many inquiries. Score 757, but was recently shopping for auto loan. DTI was under 9.54%… I think they’re going out of they’re way to decline. Let’s see how long this lasts, these things are circular…, I’ll never apply for a Citi Card again.

Approved for Chase Hilton with 100,000 points vs City 75,000 so win win… Got the Chase offer in the mail today and was instantly approved. Keep you inquiry’s City… wonder how many cards your booking per month?

I applied to Citi for a credit card, after purchasing a airline ticket from expedia & being prompted to apply. that was may 1st, 2017. they still have not made up their mind on may 8th. my credit

number is 772, I owe no money on payments of any kind, My home & three autos & two boats are all paid for, I have a sizable checking account balance & am totally confused why. I actually no longer wish to even have their card at all, under any circumstance.

I applied for the Costco Citi Visa last week, and did not get instant approval. Just received the denial letter in the mail citing “too many recent credit inquiries.” I called to have them reconsider because all of the inquiries were related to shopping for a new home – not new credit. They told me to dispute with the credit bureau?! The inquiries are all valid! Why would I do that? My credit score is 787, my income is $200K and I pay my credit cards off every month. I have no outstanding loans. Crazy.

Funny thing is – my husband has a Costco Citi card on which I am an authorized user. We spend $7000 a month on it, and now we no longer will. They lost my business.

I would recommend calling again in hopes you get a more intelligent / reasonable rep. If you have existing Citi cards, you may also want to suggest shifting existing credit in order to get approved. That usually does the trick since banks primarily care about exposure vs. credit risk. This last resort does not increase the bank’s exposure to you. Good luck.

THANK YOU! I called the numbers listed and found out my denial was due to my recent move. The address on file was different from the one listed on the application. Thank You so much!

OK I violated the 8/65 rule and applied for both the business and personal cards Citi® / AAdvantage® Platinum Select® World Elite MasterCard®.

Went to about a week and got approved for the Business card in my email. The personal card they wanted a copy of my drivers license I have no idea why and emailed that and was approved instantly upon calling back.

so success and applied for both the same day within the hour of each other and it worked!

Applied for Citi Double Cash and kept showing on status request that it was pending. On the 9th day I called and they said they would send a letter with some code or something for verification. I think they are just checking my mail address since the one on my credit report might not have been current. They did a double hp on my credit reports. Experian and Equifax. I’m still waiting to get that letter for verification, and I hope it gets approved, otherwise the double hard pull will really affect my reports. Any ideas if its for some other reason, or just want to verify address? Thought please.

Thanks

Sounds like you are probably right if the addresses didn’t match. Let me know when you hear back if you got approved and find out what the issue really was.

Were you approved? What was code for

My friend you were so right. I was reconsidered and approved for 2500

Congrats!

Thank very much I did what you recommended and just got approved

Followed these details you outlined verbatim and was approved. Thanks a ton! I applied previously and was given instant approval but went with another card. I applied again and it wasn’t instant so I called.

So, I would to share my recent experience applying for the Citi Prestige Card. On initial application, I was outright rejected due to “too many hard inquiries in the last 6 months”. I called the reconsideration line and was told over the phone that there was nothing that could be done, that it was a firm decision. That was the only reason cited (assume they’ll give you all of the reasons for a decision). However, after checking around on multiple forums I learned that some applicants had better success by appealing the decision by mail to the Citi Bank Executive Review Department. I drafted a direct, sincere, and respectful letter which sought to appeal the decision on specific grounds. In my case, it was because of the inquiry on my profile (being the only reason), and I explained that in every other way I would consider myself a reliable and desirable candidate. I received an approval notification in my email today with a reasonably generous credit limit. I am thrilled.

I received an instant denial yesterday and was pretty shocked my credit score is 752. I decided to call them today and the first person I spoke with told me it was denied due to many inquires, which I have 4 from shopping for a mortgage. The other is from American Express, approved 2 days ago 5500 limit. When I asked if they would reconsider I was told “No it was the credit bureaus decision” which of course is nonsense lol. I asked the rep if I could speak with a manager, he stated he was getting someone from his management team on the line. I spoke with a gentleman who told me that because I applied for Amex on day one and turned around and applied for Citibank on day 2 that their system automatically flagged it and said I need to wait until I receive the letter and call the number back that is provided in the letter and they may reconsider. I explained how the number of inquires can about, which he stated he was able to view them and he could see they are from the mortgage lenders and also made the comment of disputing them smh. Does anyone know if after waiting the 7 days will they approve it? It seems odd that you are penalized for applying for more than one credit card in a 2 day period. I will update what the outcome is with this fiasco.