Updated on October 22, 2016

Chase Sapphire Reserve 100k Bonus: Official Landing Page Showing Bonus Now Available!

Chase Sapphire Reserve 100k Bonus: Official Landing Page Showing Bonus Now Available!

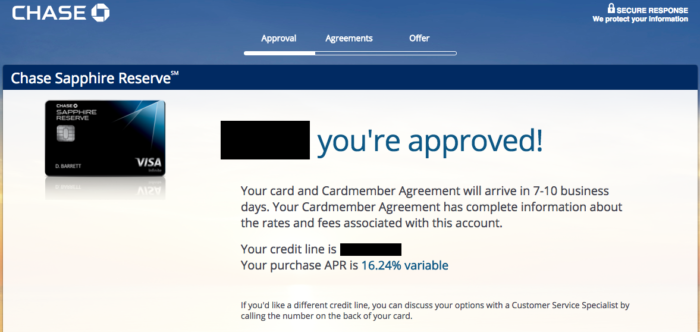

The Chase Sapphire Reserve 100k bonus offer is here – for real this time. With a real landing page that says 100k! If you have applied for less than 5 cards in the last 24 months, go ahead and apply. This is one HOT offer… probably the best of the year! The 100k points + $300 travel credit are worth $1800, or $2100 if you add in the second round of $300 travel credit. The value is even higher if you transfer the points and book award flights.

Links to apply for travel rewards credit cards can be found here – find out which cards you qualify for. Thanks for using my affiliate link and supporting my blog! Didn't get approved instantly? Try calling the Chase Reconsideration number.

CARD DETAILS SUMMARY

- 100,000 Ultimate Rewards Bonus Points after $4,000 spending in 3 months (yep just $4,000!)

- $300 Travel Credit (per calendar year so you can use this twice before your annual fee is due again)

- Annual Fee $450

- Authorized User Fee: $75

- Offer available in branches on August 21, 2016 (Sunday) and online starting today August 22, 2016.

IS THIS A GOOD OFFER?

This offer AMAZING! I wrote about the details of the card but its worth repeating. Chase Sapphire Reserve is a card that most people should think about getting. Why? A offer this valuable is rare! For spending only $4k in 3 months, you'll get 100,000 Ultimate Reward Points (I have done $10k spend to get 100,000 Amex points). But what about the big $450 annual fee? You get $300 in annual travel credit – which you can do 2x before the next annual fee hits, so you have $600 in travel credit. You are essentially getting paid $150 to get 100,000 points! The rest of the fantastic benefits are just icing on the cake.

SHOULD I APPLY?

- If you have applied for less than 5 cards in 24 months: YES!

- If you are over 5/24 (5 cards in 24 months): apply through a banker at a Chase branch. That's what I did and will let you know how that goes. My application is pending.

PointsWithACrew has summarized datapoints from various bloggers which shows that most people over 5/24 are not getting approved. That's another reason to wait and try doing it in a branch after checking if you are pre-approved.

5/24 RULE

Many readers have already exceeded the 5/24 rule (5 cards in the past 24 months, see the more detailed explanation here). Some people have ‘pre-approved' status on their Chase accounts when applying through the personal banker.

Data Points:

- In Branch: Pending – over 5/24

- Online: Approved 2/24

$300 TRAVEL CREDIT

- Receive up to $300 in statement credits annually as reimbursement for travel purchases such as airfare and hotels charged to your card*

What does that include?

Q. What types of merchants are in the ‘travel' category? (Source)

- A. Merchants in the travel category include airlines, hotels, motels, timeshares, campgrounds, car rental agencies, cruise lines, travel agencies, discount travel sites, and operators of passenger trains, buses, taxis, limousines, ferries, toll bridges and highways, and parking lots and garages. Please note that some merchants that provide transportation and travel-related services are not included in this category; for example, real estate agents, websites or owners that rent vacation properties, in-flight goods and services, on-board cruise line goods and services, sightseeing activities, tourist attractions, merchants within airports, and merchants that rent vehicles for the purpose of hauling. In addition, the purchasing of points or miles does not qualify in this category.

I applied online (No branches in my state), and got a message that they need more time to review my app, and that I will receive something in the mail within 30 days. I am well over 5/24, so I was not too optimistic. Should I bother with recon, or just wait it out?

Give it a shot and see what they say.

What is a good credit score to have before applying for these credit card deals, assuming less than 5 cards applied for in 24 months?

Yes, less than 5. 740+ is probably a safe bet.

What does $300 ‘travel credit’ mean? For airfare only or for hotels, tours, etc.?

Not just airfare. I added a section at the bottom of this post with the list from Chase’s website.

Will applying for an Amex Gold Business Card and Chase Sapphire simultaneity or a day apart makes a big deal in the odds of approving either one of them . score is 740+ , have not applied for a card in over 24 month. have 1 cap one 3000 limit, one shared cap one with 2500 limit car lease for 6k , credit history 5 years . ratio of card usage is 20% . whats your thoughts .

currently my amex application is pending called they said its with the executive office for review may take up to 7 days. . will applying for the sapphire at the same time trigger red flags for amex or chase ?

Chase will likely be checking if you have less than 5 cards in the last 24 months. So… if you are under that, you may want to get your chase cards first.