Updated on August 5, 2015

GIVEAWAY & TOP 5 CREDIT CARD DEALS FOR TRAVEL REWARDS

UPDATE: Enter the New $350 Airline Gift Certificate Giveaway

The giveaway details are below the Top 5.

THE TOP 5

Every month when I update my Top 5 Credit Card Deals for Travel Rewards, I scour the web for the best offers. I want my readers to come here and find the best offers without all the clutter — these are the offers my I'm signing up for myself or suggesting to friends and family.

Earlier this year I booked my trip to the Maldives, Vietnam, Singapore (with Kuala Lumpur still to book) for 120k miles per person in Business Class. Without miles, there is no way I could have bought these flights (which cost about $10,000 per person). Anyone can do the same.

If none of these cards are what you're looking for, check out the credit card offer directory and tools here.

THESE OFFERS HAVE EXPIRED, PLEASE CLICK HERE TO SEE THE LATEST OFFERS

___________________________________________________________________________

1) Chase Ink Plus Business Credit Card

Links to Apply: This is only available at a Chase branch. When they shrug their shoulders show them the photo of the offer here

Bonus: After spending $5,000 in 3 months you receive 70,000 Ultimate Reward Points (which are worth at least $1k if you redeem them for United Miles)

Annual Fee: $95 (not waived)

Why you should get it:

- The #1 reason: Ultimate Reward Points transfer to United 1:1 – so 70,000 Ultimate Reward Points = 70,000 United Miles

- Read my more detailed post here

- This is the highest offer I've ever seen for Chase Ink cards! The usually offer is 50k points which is increased up to 60k twice in the last two years.

- 5 points per dollar spent at office supply stores, cell phone, landline, internet and cable services

___________________________________________________________________________

2) United MileagePlus Explorer Visa

Bonus: After spending $2,000 in 3 months you receive 55,000 Miles + $50 Credit (50,000 for the business card)

Annual Fee: $0 first year, then $95

Links to apply:

- For the personal card: 50,000 miles + 5,000 miles to signup an authorized user (most of the links on other sites are affiliate links without the $50 credit)

- For the business card, log into your United account, then click this link – if you see the 50k offer…you can apply! If you see an offer for 30k, you are not eligible.

Why you should get it:

- Offer EXPIRES 9/2/14

- The Chase Ink Plus offer (above) is a business card but is better than this United offer because the points are transferable to more United miles (plus several other airlines if you prefer). In addition, they are more flexible because you can transfer them to someone else's account.

- The personal card offer is now available for everyone while the business card offer is a targeted offer (not everyone is eligible). To see if you are eligible, go to United.com and log in. On the top right you should see a banner offering for the credit card. There is another offer out there for 30,000 — DON'T TAKE THAT OFFER!

- 5,000 bonus miles (for the personal card, not the business card) after you add an authorized user to your account and make a purchase with your Card during the first 3 months

- Some additional nice features are: 1st checked bag free, priority boarding, no foreign transaction fees, 2 United Club passes (I never seem to find a time to use them) and a few more things you can read about on United's website.

- Previous cardholder? You are not eligible if you received a new member bonus in the last 24 months.

___________________________________________________________________________

3) Citibank AAdvantage Executive MasterCard

Link to Apply (the 60k offer expired around 8/19/14, the best offer is now 50k: link1 or link2)

Bonus: After spending $5,000 in 90 days you receive 60,000 50,000 miles + $100 statement credit

Annual Fee: $450 (but after the $100 credit on your first statement the fee is really $350)

Why you should get it:

- The 75k offer just died today, so the

60k50k offer is now the best AA offer available. - I hope the 100k offer returns but my original detailed post explains why it was great which still applies to the 75k offer

60k50k miles can get you 2 domestic round-trip coach flights, with 10k miles left over- Free Admirals lounge membership, 1st checked bag free, no foreign transaction fees

___________________________________________________________________________

4) US Airways World Mastercard

Link to Apply [EXPIRED]

Bonus: After first purchase and payment of $89 annual fee you receive 40,000 miles

Annual Fee: $89 (not waived)

Why you should get it:

- Read my more detailed review I wrote here. The short answer? There is no spend requirement!

- I don’t like annual fees but this makes it easy for anyone to get miles without worrying about any minimum spend requirements. Is $89 worth 40,000 miles? Of course! You can’t buy points for $0.002225 each. And these will be merged with AA miles eventually.

- Fly to North Asia once you have 60k miles (Japan, S.Korea, Taiwan, Macau, HK, China, the ‘stans, and Mongolia. Most airlines charge 70k miles to most of these destinations. Add the bonus to your existing miles and you may have enough.

- Additional perks:

- First Checked Bag FREE (for you and up to 4 companions on domestic US Airways flights)

- One Companion Certificate for up to 2 guests ($99+taxes and fees each) and Priority Boarding Zone 2.

___________________________________________________________________________

5) IHG Rewards Club (formerly Priority Club) Mastercard

Bonus: After spending $1,000 in 3 months you receive 80,000 points

Annual Fee: $0 first year, then $49 (but well worth keeping and paying the fee, read on)

This offer is for 80,000 IHG points (formerly known as Priority Club) compared with the usual 60,000 offer which you can find on Chase’s website. IHG is the hotel chain best known by its Holiday Inn hotels, as well as the Intercontinental hotels. One reason I don’t like this offer is because when you click on the link, there is no official landing page (you don’t know what you’re getting when you click the link to apply). That means you’ll have to confirm the offer after you apply and get approved. People have been having success and posting results at this Flyertalk forum.

Why you should get it:

Figure a typical hotel night will cost you 15,000 to 25,000 points per night at a Holiday Inn. That will get you 3 to 5 nights. If each night is worth approximately $150, its worth $450 to $750. Here is the redemption chart so you can get a better idea. To make it even better, every year you will get 1 free night at any of their hotels. I used mine for a room on New Years Eve at the Intercontinental Times Square (the cash price was ~$750 +tax). You do pay the annual fee but the $49 fee is well worth it to receive a free night at an Intercontinental hotel for example. Even some Holiday Inns can cost $200+.

___________________________________________________________________________

HONORABLE MENTIONS

6) Barclay Arrival Plus World Elite Mastercard

Bonus: After spending $3,000 in 90 days you receive 40,000 miles (with the 10% miles back its worth $440 to use for any hotel, any airline, anytime)

Annual Fee: $0 first year, then $89

Why you should get it:

- EASY: Its easy to get the bonus due to the relatively small spend requirement (some other cards are $5k or $10k)

- NO BLACKOUT PERIODS: especially during holidays, you can easily use these miles for a $400 credit anytime without trying to figure out which airline to search and problems finding availability. No, its not the biggest or best bonus, but for many people (especially beginners) this may be the only one that makes sense.

- 2x MILES ON ALL PURCHASES and NO FOREIGN TRANSACTION FEES which will save you money when you travel internationally.

- GET 10% MILES BACK – redeem 40,000 miles and you get 4,000 back (worth another $40), so you get a total value of $440. It really doesn’t get easier than this. If you are short on time or don’t feel like trying to figure all how to use miles, this is the card for you.

- Free FICO credit score

___________________________________________________________________________

7) Citi Hilton HHonors Reserve Card

Bonus: After spending $2,500 in 4 months you receive 2 FREE WEEKEND NIGHTS (worth up to ~$2,400) + $100 Credit + Free GOLD Status

Annual Fee: $95 (but you get $100 Statement Credit with first hotel stay in 3 months)

The part of this offer that is most valuable is the 2 FREE Weekend nights. As I mentioned here, I booked the Hilton Conrad Maldives for my honeymoon. It now goes for a whopping 90,000 points per night or around $1200 per night. Try saving enough Hilton points for that (it cost me only around 45,000 points per night when I booked it last year). These Hilton hotels are excluded.

Why you should get it:

- EARN A $100 STATEMENT CREDIT after $100 or more on your first hotel stay in the Hilton HHonors Portfolio within the first 3 months of account opening.

- EARN TWO WEEKEND NIGHT certificates, each good for one weekend night (standard room, double occupancy) at select hotels and resorts within the Hilton HHonors portfolio, after $2,500 in eligible purchases within the first four months of cardmembership.

- ENJOY COMPLIMENTARY HHONORS GOLD STATUS as long as you are a cardmember. Earn an upgrade to HHonors Diamond status when you make $40,000 or more in eligible purchases each calendar year.

- NO FOREIGN TRANSACTION FEES ON PURCHASES.

- TRAVEL WITH EASE and enjoy global acceptance with your Citi chip credit card.

- EARN AN ANNIVERSARY BONUS OF ONE WEEKEND NIGHT certificate good for one weekend night (standard room, double occupancy), at select hotels and resorts within the Hilton HHonors portfolio when you spend $10,000 or more on eligible purchases each card membership year.

___________________________________________________________________________

GIVEAWAY!

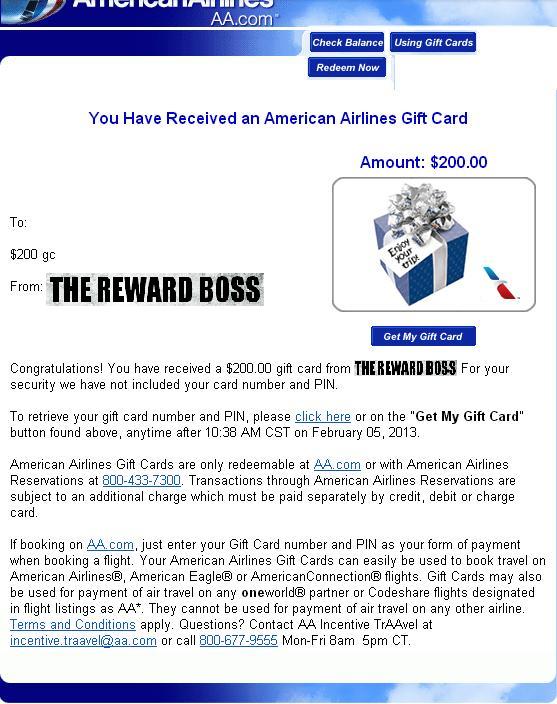

To celebrate my joining of the BoardingArea.com & prior2boarding family, I'm giving away:- $200 American Airlines Gift Card with NO Expiration Date (bought using the American Express $200 credit for Airline Expenses – see #2 on last month's Top 5)

- 2 United Lounge Passes (expiring 11/30/2014 and 10/31/2015)

HOW TO ENTER

- Enter a comment below and tell me 1 credit card you hate or love the most and why for ONE entry. Be as kind, harsh, or funny as you would like. You can enter once per day per person.

- Like me on Facebook, follow me on Twitter or Google+ for TWO entries each.

- Share this post via Twitter or retweet my tweet for this giveaway for TWO entries

- Subscribe to receive email updates from TheRewardBoss on the top left corner (or bottom of the page if on a mobile device) for TWO entries.

DEADLINE: All entries must be in by Sunday 8/10/14 at 11:59 pm EST.

WINNER: Two (2) winners will be randomly selected (one for each prize) on Monday 8/11/14.

Which cards are your favorite and how do you plan to use these bonuses? Not sure what to get? Let me know where you want to go and I'll be happy to help you get there!

[In full disclosure, the Reward Boss gets paid a referral if you use some of the card links above for but for the others this is not the case. I research and post my opinions on the best deals I can find, regardless of whether there is a commission available. You don't have to use my links but I really appreciate if you do. As always, if you have any questions please feel free to post comments below. These statements have not been reviewed or approved by any of the above companies.]

Want to see how I earn enough points and miles to travel for free? Read this first. Be one of the 10s of 10s of people who subscribe to receive email updates whenever I post a new article. Enter your email address in the top left corner of the site (mobile users scroll down) and that’s it. Cancel anytime. Follow me on Facebook, Twitter, Google+, or RSS feed.

Citi Exec AA because i can churn and burn baby!

Chase Ink +; frequently buying those Amazon gift cards for 5X UR points.

I love my sapphire preferred because the points can be transferee to so many great partners!

I like my Alaska Visa because Alaska has such great transfer partners.

My favorite is my Club Carlson Visa from Barclay for the bonus night on redeemed point stays. I’ve stayed in some beautiful European properties with an extra evening free!

Welcome to BoardingArea and thanks for the contest.

lik CSP. for the flexibility of transfer partners

US Airways card: 5000 fewer miles for redemption.s

SPG Amex, for the good transfer rates to AA miles, and for good redemption opportunities.

I’m torn between Amex Plat and Chase Sapphire Preferred.

But I think ultimate, the sapphire preferred wins out based on lower annual fee, and transfer-ability.

Not a fan of the united explorer card…just not the best mileage program to spend towards anymore

I like the Amex Costco card. I earn points for doing my normal shopping!

Sapphire Preferred for me. You just cannot beat the transfer partners and the annual bonus (which is sadly ending).

I love CSP because they just added Primary car rental ins

CSP for ability to transfer to some pretty good partners

Chase Freedom for its rotating 5x categories

Live theClub Carlson Card and the free night for my Europe travels

Citi Exec AA is what I’m using now. But I want the World Arrival+

Grandfathered Citi Forward – 5x dining/Amazon ftw!

My favorite is the chase sapphire preferred. I love being able to transfer to BA for cheap flights to Florida!

Old Amex Blue for unlimited 5% back for everyday.

My favorite card is SPG Amex due to 5000 bonus miles transfer if I transfer 20,000 miles.

I love the CSP for its 2x earnings in dining and “travel”, as well as the flexible use of UR points (especially when paired with the Freedom rotating categories).

Love my (old version) Amex Blue cash. Huge MS earning potential for some. For me, 5% back at gas stations & grocery stores rocks when you have kids.

Citi Exec AA because of the recent sign up bonus 100k, lounge access. I just wish it would get me into Alaska lounges without same day travel. I also wish there was still an AA lounge at MCI, my new home airport. Oh and MCI, time to remodel and join the 21st century.

The Delta Skymiles card is awful. >:O

Love the Citi exec plat 100K, high fee but high reward!

The Chase Sapphire Preferred is great, lots of transfer options!

Love Chase Sapphire Preferred combined with Freedom when 5X points. Hate, ah,,, Barclays Bank! Declined me THREE times in a row……Super bummer…

SPG Amex because I almost always want to stay at SPG properties

I like the Hyatt visa! Stayed two nights at Park Hyatt Paris with the sign-up bonus and them used annual free night at Park Hyatt Seoul!

I love my Amex Platinum for the benefits (and the 100K bonus when I signed up last year). But the annual fee is annoying.

Citi Exec AA MC so I can go into the AC with my kids and make y’all mad

😉 j.k.

I like my marriott rewards card because I’ve had the account for 20 years

Chase Ink for the 5x points.

I like the SPG AMEX since you can use it on hotels or airlines, you get the 5K bonus for every 20K you transfer, and the insurance/warranty protection.

Delta Amex for the MQD waiver

Club Carlson for the free night redemption

I have a few faves. SPG Amex for transfer bonus and lots of airline partners. Delta Plat Amex for the bonus MQM’s for annual spending & my Arrival cuz the points cover things that wouldn’t normally be covered by miles.

I like the Amex Plat, but CSP is a close second.

hard to choose just 1, but we will say Ink for 5x

Club Carlson for 2nd night free and 5x on everything

The Starwood Amex Card. The cash and point option with Starwood points has saved me a ton of money without having to deplete my points very much! This card gets me a ton of Starwood points, which are hard to come by otherwise.

My favorite card is the Club Carlson Visa. The last night free on any award travel makes for a lot of cheap weekend trips!

I LOVE my Ink Plus card. I got a $700 room during the Kentucky Derby for only 8000 points that I transferred over to my Hyatt account.

I love my amex platinum card cuz it gets all the chicks when i whip it out.

wait, you mean the Centurion Black card…

No kidding if only the Platinum card was badass like the Centurion card!

Chase Sapphire Preferred. UR can be transferrable to many partners.

Platinum Delta Amex, great card thanks to MQD waiver, bonus miles and bonus MQM at 25k and 50k spend thresholds, baggage fee waiver and free companion ticket

I like my Sapphrre Preferred card for the transfer partners

Amex plat card since I got the 150000 amex points offer

United Mileage Plus: I’ve had 2 jobs & worked 6-7 days a week for 6 yrs. Took my 1st real vacation (and flight) in over 10 yrs. Got the travel bug, got the card, & discovered the wonder world of points & reward message boards. Just booked my 1st award ever! 2 rnd trip Super Saver tix to Hawaii. Still a newbie but learning fast. Hope to see you in F one day!

Anxiously awaiting my Sapphire card to arrive…

Chase freedom – no fee and 5x bonus each quarter

my go to card is SPG – being that I stay at SPG brand hotels & the great airline transfer bonus

BA Visa – those 4,500 point redemptions for short haul trips on Usairways, AA, S7, etc. are priceless. No foreign transaction fee abroad is a nice bonus.

Avios are perfect for those short flights to get you all around Peru (see post)

They all want you in debt to them so lol…I’ll pass on choosing a favorite but I followed on Twitter, Google+, liked your Facebook page, and tweeted here: https://twitter.com/LuvMyHubz/status/496852414327050240

Shocking, but I really like the IHG card. Paid the annual fee every year. The free night more than offsets the annual fee. Best card ever (but not for regular spending…)

I’ve had this card for years for the annual free night in exchange for the annual fee.

I love the Chase Hyatt card because it got me to the Park Hyatt Vendome for Christmas!

I hated the SPG AX card– they failed to honor their agreement of bonus points even though I had it in writing.

I had a similar problem with Amex Gold when they offered the 100k and 75k bonuses. I communicated with them over their secure email and convinced them to give the points as they promised.

I love the Chase Ink Bold or Ink Plus…wow 5x points at office stores and telecom/cable bills. It’s so great to get that 5x as the Ultimate Rewards just stacks and stacks.

Lufthansa’s Miles & More – I m German 🙂

AMEX Platinum; even though they yanked Admirals Club membership from us, there are still plenty of lounge options. That, combined with the $200 airline credit, Fine Hotels and Resorts program, and amazing flexibility of the Membership Rewards program make this card worth the (hefty) annual fee.

My Chase Sapphire for the transferable points and bonus dining and travel categories.

US Bank Club Carlson Gold. 2nd award night free is awesome.

United MileagePlus Club card because of the x 1.5

Starwood Amex, I love the transfer options and the 5K bonus

The Citi Executive card because nothing can top 100k in nearly free miles

love the amex plat 40000 points and a ton of benefits def out weigh the 450 a year cost

Chase Ink Bold because of the bonus rewards

I like my Chase Sapphire Preferred card able to transfer points to many great partners.

Sign up bonus for the Hyatt Visa is great. Used my two free nights at the Andaz Amsterdam, awesome hotel.

Hilton reserve card 2 nights at the best hotels

ink plus card for flexibility in transferring points

Chase Ink or Bold for 5x at office supply stores and for cell phone bills. I don’t have a small business, so I haven’t applied.

AMEX Everyday, for all those everyday bonuses purchases, plus Amex Sync offers!

United MileagePlus Explorer Visa for first year free

Delta AMEX platinum for free comapnion ticket and MQMs.

Ink Plus… 5x points!

The Barclaycard Arrival as it’s great for earning pts through spend.

chase hyatt visa for 2 nights at the best hotels

How are you keeping track of all these random ways to enter the contest? Also, I don’t see a tweet about the contest to retweet for 2 entries…

@Ryan, thanks for pointing that out. The tweet is out there now. I also updated the post to say you can share this contest via twitter (there are sharing buttons at the bottom of the post) or retweet my tweet. Both are ok – some people have already sent tweets. Its easy to check who entered, just time consuming. I’m sure there is a faster way with some software.

Yeah it seems like most blog giveaways are using something called rafflecopter… I’m guessing they keep track of everything for you.

Thanks for the tip – I’ve seen rafflecopter before and will check it out. Most giveaways I see here on BA look like they do it manually.

Starwood Amex for the bonus 5K transfer poitns!

Definitely the Citi Exec AA 100K from a bit ago. I was able book two tix to BA for pennies (well close to it)!

Sapphire because of the transfer partners and also almost all of my spend is either travel and/or food related.

My favorite card is currently the Amex Business Platinum… 150k targeted bonus with $20k in 3 months, and I’ve already used the statement credits for $200 in southwest gift cards and the $100 global entry!

Citi Exec 100k. Wish it would come back!

US Airways Mastercard. Can’t beat the companion certificate espc with living in one of their hubs. Makes for easy travel with friends

Love the Chase Sapphire since you can transfer the points to many airlines and hotels.

AMEX Delta Platinum–formerly useful, now just expensive.

I like the Chase Sapphire Preferred because of the flexibility it offers. I also like the discounted rental car rates on the UR portal.

Citi Simplicity because of the 0% intro APR – did someone say SHOPPING SPREEEEE???

ihg chase card low annual fee free night every year at any hotel

hilton reserve card those free nights at exquisite hotels are just great

chase ihg for low annual fee, platinum status, and free annual night certificate redeemable anywhere.

I love the Barclay Arrival Plus World Elite Mastercard because you 2% on all purchases, it’s easy to earn and easy to redeem.

I like The Reward Boss on facebook, follow on Twitter, and follow on Google+. I subscribe to your emails and I tweeted here:

https://twitter.com/camistuff1/status/497155817800347648

I like the Chase Sapphire Preferred because it has the most transfer partners and the best for my travel.

I like the CSP card for its benefits (primary car insurance, 2X and 3X points) and extensive transfer partners.

Delta Plat for MQD waiver!

I love my CSP because it’s so easy to transfer to partners.

I like the chase freedom for the great rotating 5x cash back (that I can transfer to my CSP)

I’m not ashamed to admit I love my Virgin America Visa. Waived change fees + up to 15,000 status points/year is a huge benefit.

United Club, 1.5 mile/dollar for general spending is quite unbeatable.

I got the Citi Exec AAdvantage Card with the 100K miles offer! Awesome.

We’re really happy with our Capital One No Hassle card.

I follow you on twitter! @channynn

I follow you on twitter! @channynn

2

https://twitter.com/channynn/status/497423718339973120

I love my Chase Ink Bold for 5x at office supply stores. I buy all sorts of things at Staples now 🙂

Like Chase Ink the most due to the 5x categories.

100K AA mastercard executive platinum. So many points AND free club visits

I like Barclay’s Arrival+ for 2% everywhere!

I love my Chase Sapphire Preferred even more now that the trip insurance coverage has been increased.

Love my Mileageplus Visa Explorer from Chase because of the pretty solid bonus. They also have a phenomenal customer service, phone as well as email. Very kind and helpful.

Love Chase Freedom due to no fee and 5x bonus categories

My old BoA Cash Rewards card is fairly useless, but pales in comparison to my vanilla Amex with absolutely nothing. Can I pick ’em or what?!

I do not have one yet, but I am a fan of the CSP and Amex Everyday Preferred. I am still trying to figure out which Hilton card is better.

The AMEX PLUM Business card. When it first came out, there was a 2% cash back on ALL purchases. Miles and points are great, but sometimes cash is nice. However, the new sign up is 1.5% only. You will still get the 2% if you had it from the beginning.

United Explorer now that the 55k offer is available again.

Chase Ink Plus for the flexibility of UR pts

Amex plat for centurion lounge access

I love Chase South West cards. By applying SW Plus and Premier cards you can get companion ticket and two can fly for the price of one. I love chase credit cards.

Love Club Carlson Cards. 2 for 1 is the best deal around.

I love the Citi Hilton HHonors Reserve Card because we got two free nights in Washington, D.C. that are usually $325 a night!

I love my Amex Blue because of the twitter offers you can link, I’ve used quite a few that had good rewards, spend $40 for $25 back at Costco….that was easy.

I think the Chase Ink Bold is amazing. Great bonus categories, great sign up bonus.

I love our Chase Ink Bold! We got 60,000 UR points and 5x in great categories!

Cami – did you try getting your 60k bumped up to 70k? Read more here

Chase Sapphire Preferred! Since it has 2x on travel & dining. And I value UR points so much. Also I usually rent a car a lot while I’m traveling so the added primary rental insurance definitely a plus too.

United MileagePlus Explorer because the miles, perks, and Chase customer service!

Barclay Arrival is my favorite. 2.2 Cash back when used for travel. Free fico score. Trip it pro and many other benefits.

Chase ink plus for the UR flex

AMEX Platinum. I signed up with a code for 100K points. I met my spend requirement and 5 months later no points. I call AMEX, they hemmed and hawed then denied the code was real and offered me a measly 5K for my troubles. I cancelled the card.

love the hyatt card free night every year

Honestly, I have never had a credit card. No extra air miles for me, but no debt either!