Updated on April 6, 2017

Overview

My 2nd billing statement just ended for the Citi Prestige® credit card and I was pleasantly surprised to learn of 2 unadvertised perks:

- My annual fee was reduced from $450 to $350 because I have a CitiGold checking account – this is despite having applied for the 50k bonus after $3,000 spend

- The $180 fee I paid for the AA Platinum challenge counted towards the $250 annual air travel credit

$350 Reduced Annual Fee – Citi Prestige®

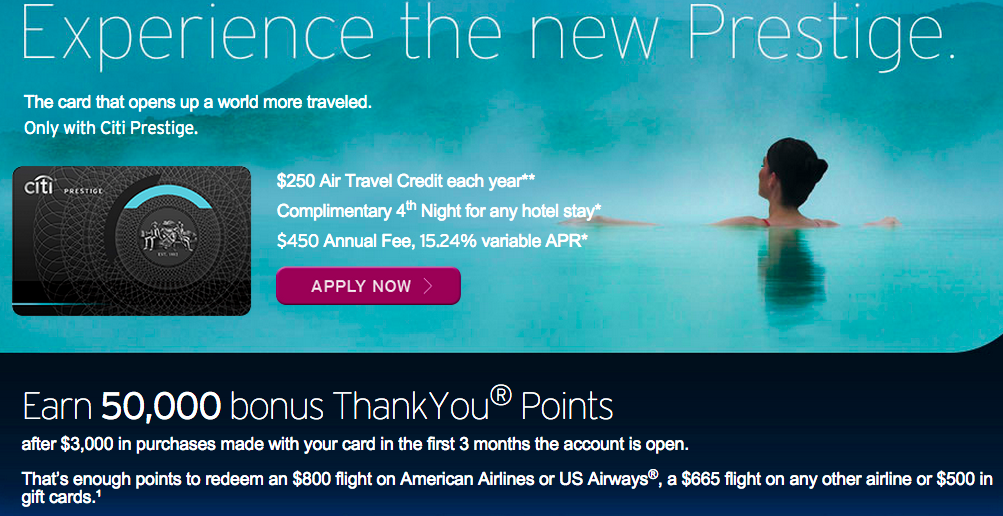

I signed up on 4/9/15 when the offer first came out – it offered 50,000 bonus Thank You points after a mere $3,000 spend within 3 months. There was a second offer of 50,000 bonus Thank You points for CitiGold members with a reduced $350 annual fee but this required:

- Applying in-branch, which, believe it or not, is an extremely manual paper application process without a possibility for instant approval

- A whopping $15,000 spend within 12 months

I wanted my TY points ASAP, so the opportunity cost of waiting an extra 9-11 months wasn’t worth the $100 savings in my book. I signed up for the publicly available offer. I woke up today to see the 50,000 bonus Thank You points had posted and more importantly that my annual fee was automatically reduced to $350 without having to ask. My colleague, who is also a CitiGold member, had received snail mail from Citi which explicitly stated the $100 reduction. Oddly, I did not receive such mail, but nonetheless, received the same discount. Sweet!

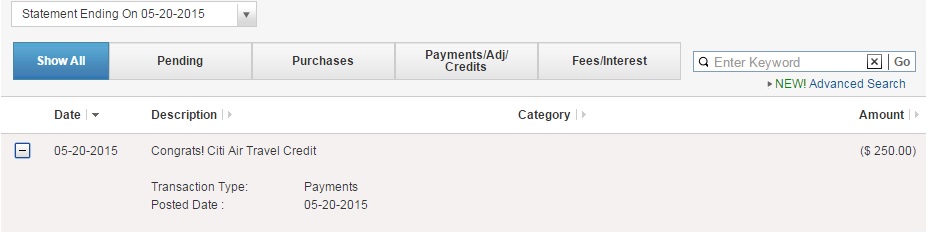

AA Platinum Challenge Fee Processed as Air Travel

I had previously posted that I enrolled in the AA Platinum status challenge since I was one of the many lucky people who scored a Beijing mistake fare. I had also noted that it would be interesting to see if the $180 challenge fee would count towards the $250 annual air travel credit. I am happy to report that it DOES count towards the $250 air travel credit. The charge was processed as “Air Travel AMERICAN AIRLINES” according to my detailed statement.

If you happened to have scored a Beijing mistake fare and the trip has been completed, it’s not too late to sign up for the AA Platinum status challenge and have the start date back-dated. If you have the Citi Prestige card, charge the challenge fee on the card and receive the fee back in the form of statement credit.

Note: I had $70+ worth of actual air travel related charges (taxes and fees on award tickets) in addition to the $180 challenge fee.

Sign-up Links

- Direct Link (non affiliate)

Open a CitiGold Checking Account

If you currently do not have a CitiGold checking account but plan to sign up to shave $100 off the Prestige’s AF, be sure to sign up for the latest promo – 30k bonus AA miles.

Related Posts

Any data points on signing up for a Citigold account after already having done the Prestige 50K offer for $450 and getting a reduction (either automatic or calling in)?

Now that, I am unsure of. Citi is generally consumer friendly. As always, there is no downside to sending a secure message and requesting for a $100 statement credit to reflect your CitiGold status.

Doesn’t matter what order you do it in, you’ll get the $100 discount. Should be automatic as long as the accounts are linked, but you can call in to get it done faster.

Do I have to do anything to link the accounts or is it automatic? I was approved for Prestige and then I applied for Citigold acct. I am yet to fund the checking acct with Barclays AP card. If I do, can I bill pay from Citigold acct the same amount back to my Barclays card?

If you have the same login username at citicards.com it will be automatic linking

Do I have to do anything to link the accounts? Or is it automatic?

No Citi Gold account (or any Citi account). Signed up in-branch today successfully for the $350 AF. SO HAPPY