Updated on February 19, 2016

Overview

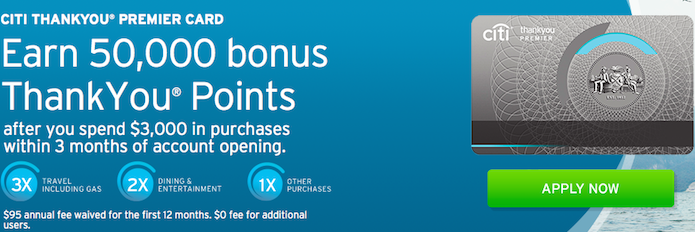

Citi has gotten aggressive with pushing its credit cards. First it was Citi Prestige $1,350 Deal and now they have upped the sign-up bonus to 50K for the Citi Premier after spending $3,000 in 3 months. Citi cites that you can get 1.25c per Thank You (TY) point, which comes out to roughly $662 when redeeming TY pts for airfare. In addition, here are the perks that come with the card:

- 3x pts on travel and gas

- 2x pts on dining and entertainment

- 1pt per $ on all other purchases

- $95 annual fee waived for the first year

How to Score $848 AA / US Air Credits (instead of $662)

What I want to share in this post is how to squeeze 1.6c per TY pt instead of 1.25c. If you already have the Citi Prestige card, all you need to do is combine your TY points into 1 account and your entire TY point balance will automatically be upgraded to the 1.6c conversion rate when redeeming for AA / US Air flights. MileValue provides step by step instructions on how to do this – so I won’t rehash what’s out there. Once pooled together, your 50,000 bonus pts + 3,000 base pts (from the $3,000 spend) will yield $848 worth of AA / US Air credits instead of $662. The catches are:

- Credits must be used on AA / US Air operated flights and not codeshares operated by partner flights

- Airfare booked through Citi tend to be $5 – $30 more than what I find off skyscanner

- Incentivizes you to book AA / US Air flights, even if more expensive than competitor flights

- Adds pressure to have future travel plans that need to be booked 1 year out (just the booking, not the travel dates)

Earning EQM/EQP

On the upside, flights booked using TY pts earn EQM/EQP as though you were booking with cash or credit card. I recently pointed out how I will be attaining Platinum status through an AA challenge, however, it only secures me Platinum status until Feb 2016. To secure Platinum until Feb 2017, I will do my best to earn the remaining 22,000 EQPs this year using the AA / US Air credits.

Transfer TY pts or Redeem at 1.6c for AA / US Air Credit?

I typically advocate transferring Chase UR, Amex MR, and Citi TY pts to airlines… so why I am not doing the same with the Prestige and Premier?? One of the biggest challenges with award redemption is the ability to find saver award seats for the dates you desire. There will be instances, in particular during peak season, where award seat availability is slim to none and paying the standard award rate is not a slickdeal. During these instances, using the credits at the 1.6c per TY pt valuation makes sense, especially since you earn EQM/EQPs for the flight. However, if you are in the reverse scenario where you don't have any future travel plans during peak season or you are able to find more value than 1.6c per TY pt, you may be better off transferring 1:1 to one of Citi's many partners.

Sign-up Strategy

I highly recommend getting both the Prestige and the Premier cards to double up on value. If you do not have the Citi Prestige or Premier cards yet, I would sign up for the Citi Prestige card first to take advantage of the $1,350 in value, $100 statement credit for Global Entry, and Priority Pass Select membership (which arrives 1 week after you get your Prestige card). Keep in mind Citi has a strict 8/65 rule, which is no more than 1 application within 8 days and no more than 2 applications within 65 days. Once you get the Prestige card, call up Citi or send a secure message to request for a decrease in your credit line. This will free up available credit to increase your chances of getting instant approval when you apply for the Premier.

For whatever reason, if you choose to only sign up for 1 Citi card, I would choose the Prestige over the Premier. Sure, it comes with a hefty $450 annual fee whereas the Premier is only $95 and is waived for the first year. However, the $250 air credit is worth $500 since the perk works off calendar year, and you are already $50 ahead of the game vs. the Premier. Throw in all the other perks, and you have yourself a no-brainer.

SIGN UP LINKS

Citi PRESTIGE 50K

- Direct Link (I don’t receive commission if you use this link)

Citi PREMIER 50K

- Direct Link (I don’t receive commission if you use this link)

I appreciate the fact that you also add the direct links as well as the affiliate link. Although I don’t see any benefit in clicking the direct link over the affiliate link it shows integrity. For this reason, if everything is equal, I would prefer using the affiliate link over the direct link and prefer using your affiliate link over another travel blogger’s.

Thanks for your comments!