Updated on September 30, 2016

Approved for the JPM Reserve 100,000 Bonus Offer

This morning, my friend received a call from a JPM representative to confirm some details about his application. After 5 minutes, he was approved for the new JPM Reserve card, with the 100,000 sign-up bonus. That's on top of his recent Chase Sapphire Reserve 100k approval! That's right, he just locked in an easy 200,000 Ultimate Rewards bonus from 2 Reserve card signups!

After I heard this, I checked my Chase account online… I was approved too!

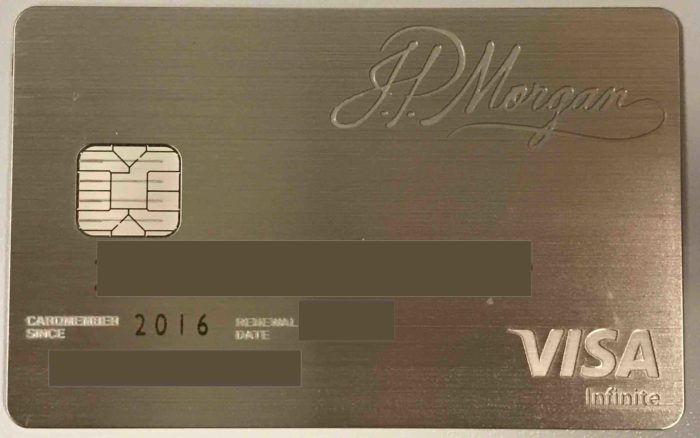

UPDATE: The card arrived. Check out my unboxing video.

Applying for JP Morgan Reserve Card

Last week, I confirmed the new 100K sign-up bonus for the JPM Reserve card and I also posted about the hoops my friend jumped through to get approved for the Chase Sapphire Reserve 100k offer. After we both were initially rejected for the Sapphire Reserve, we both applied for the JPM Reserve card by fax (details in my previous post). And no, neither of us have $10M with Chase, not $5M, not any M. Both of us have ~ 1K sitting with Chase.

Recap of the JPM Call

The JPM rep said my friend had been aggressively signing up for credit cards in the past 24 months, with 10+ new accounts in the past 12 months and asked for an explanation. My friend explained that he has several businesses and wanted to separate personal expenses from each of his business expenses.

He also had to confirm his annual gross income and monthly housing expenses (mortgage/rent). He provided his real income and didn't inflate anything. The rep pointed out Chase recently extended him a large amount of credit, could not extend any more, and would need to move some credit around to accommodate the new card. He asked for $15k to be moved from an existing Chase card to the new JPM Reserve card which resulted in an approval after a 3 minute hold.

I didn't apply for as many cards as he did. As a result, they probably didn't need to call me. I was, however, also over the 5/24 rule.

How to Check If You Are Approved

If you've recently applied for the JPM Reserve card and are still waiting for a response, it is possible JPM approved you for the card without a phone call. A Chase application status / reconsideration line exists for Chase credit cards but does not exist for the JPM Reserve card. One reader has said they are able to see JPM applications.

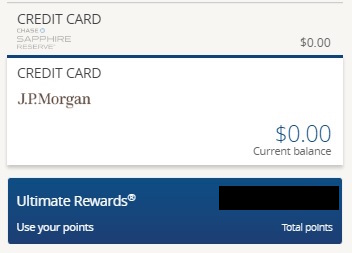

Check if you are approved by logging in to your Chase account and looking for a new “JP Morgan” account (below). As far as I know, this is the only way to check status. My other friend, who is a legit Chase Private Bank client, applied for the JPM Reserve hours after I did and was approved eventually.

Data Points

- Approved: both me and 2 friends (1 PBC) – see comments below for further updates

Does the 5/24 Rule Apply to the JPM Reserve Card?

Based on data points so far, the 5/24 rule does not appear to apply to the JP Morgan Reserve card. Whether you are shooting for the exacta (200k from both Reserve cards) or you didn't get approved for the CSR because of 5/24, this JPM Reserve card is the real deal and attainable… at least for now.

Is a Trifecta Possible (3 Reserve Cards for 300K)?

Check out this post on FlyerTalk. Apparently user darkhound was previously a JPM Palladium cardholder, who received 100k UR pts for converting to the JPM Reserve card. At the same time, he was also approved for the Chase Sapphire Reserve 100k offer and had also submitted his application for the JPM Reserve card for another 100k. Good luck to you!

JPM 100K Application

Application Link (fax only): Application PDF

Before you decide to apply, 1) if you are below 5/24, apply for the Chase Sapphire Reserve first and 2) keep in mind our applications (my friend and mine) were submitted early, and even then, JPM was supposedly receiving over 1,000 applications per hour. Since then, the JPM Reserve card application was posted publicly and I can only imagine how many more individuals applied.

If you decide to apply now, you may not receive a response for weeks and by then JPM may be more stringent on approving the average Joe (like me). Good luck!

Also, if you are not comfortable sending your info via fax, don't! Google the number with hyphens and you'll find many references that look legit. Without the hyphens, not so much.

Update: Fax line has been disconnected. Those who successfully faxed in their application prior to 9/1/16 have a shot at getting approved. Those who faxed in 9/1/16 and after – your app is probably in the shredder. See comments below for data points.

Related Post:

Transferring Ultimate Reward Points Between Chase Accounts

My gut reaction to your title was… “What a show-off……”

But Wow. I just submitted my application. This would be huge as I was not pre-approved for the CSR.

Fingers crossed.

did you fax it in yourself or have chase banker do it?

Fax

I applied on Thursday and it’s currently pending. At 6/24 and was denied for CSR. What are my chances here?!?!

I would say about the same chances of you being approved for a Fairmont, Ritz, or any other Chase card that doesn’t follow 5/24. Besides the 2 cases described above, there are now more cases of non-PB clients getting approved. May the CC Approval Gods be with you!

Are you positive 5/24 won’t apply? Seems like too few DPs so far. This would be a cc miracle

Nope, not sure…. except I had a few other friends text me just now that they also got approved – and they are way above 5/24

Did any of them have their app pending? That’s got me nervous.

There is no phone number to call so it’s tough to tell if the app had been pending for 1 week or if the JPM cc processing dept only got to the app this morning.

When I called the normal Chase line, they said I was pending. Applied last week after being denied CSR. Hopefully there’s a chance.

When did your other friends apply?

Wed/Thurs

got denied for 5/24 today on csr. So sent in fax app for jpmResrv. If I also apply for Ritz card (to combine inquiries) will it negatively impact my chances for getting the jpmorganreserve?

Thanks!!

Yes it will negatively impact your chances – but as you can see with the case with my friend, he still got approved. Depends on how lucky you feel. Regardless if you decide to apply for the Ritz or not, be prepared for that call where the JPM rep says something along the lines of “I see you have been aggressively applying for credit cards – why is that”

With an assumed approval for the Ritz, you might find yourself in a tough spot to explain why you would need both cards.

Thanks. Guess “because I want both bonuses” won’t work :p

I want to make a few large purchases so I wanted to get a card pretty quickly. But it’s probably a better bet to wait for jpmResrv first then apply online for Ritz, right?

Yes, that’s what I would do. Reserve is on my top priority so would want to do everything in my power not to jeopardize my chances of approval.

Mine’s got to be near the top of the list then. I guess I will check my chase.com account ever now and again

The chances your pull from a faxed app and the Ritz app are done the same day are almost zero.

How long is it taking to receive the Sapphire Reserve card after approval? I understand they will not send any rushes and are using US mail.

Got mine in 3 business days. Friends got theirs within 2-5 business days.

I got approved for CSR today. I don’t have a PB or any banking relations with Chase. This probably won’t help if applying for the JPMR. Debating if it is even worth the fax. Any thoughts? I’m at 2/24.

What’s another hard pull worth to you? Not a whole lot for me.

just worried about adverse effects like the amex 100k fiasco.

Better to ask for forgiveness than to ask for permission, right?

Any DPs on approval for the Reserve without a Chase checking or savings account? I currently have 4 Chase CCs but no accounts and the closest branch is ~1.5 hour drive away.

My thought process is this: I’m currently heavily involved in the management of a family trust which will either be dissolved or transitioned/reformed due to the death of an elderly relative. On a reconsideration call with JP Morgan, I would suggest that I am considering the possibility of moving these trust assets to Chase in hopes of influencing them in favor of my approval. If those without Chase bank accounts are flat out being rejected, though, this might not be the best approach and I may consider opening an account online.

No DPs unfortunately. My friend ran to the local chase branch after faxing in the app because he felt it would make a diff. Would imagine JPM had the checkboxes on the app for a reason, no?

That was my initial thought, but then I figured if I could at least get the call from JPM, offering to consider bringing in a 6 figure account would weigh heavily and save me the effort of opening an additional bank account.

Not that I don’t believe you, but anyone can say that… quite a stretch to think that a JPM credit analyst would just simply take your word for it, no?

Fair enough. Although I think lying about your financial position to a credit analyst would probably constitute fraud, whereas anyone can brag their way across the internet. God knows I don’t have that kind of personal assets to be moving around even if I could potentially get some trust assets moving, I guess it’s probably worth the effort to open a checking account before faxing it in. Ah well.

I didn’t lie about income. Neither did my friend. And when the rep spoke w my friend, he reconfirmed his 6 figure, non inflated annual income.

I’ll clarify in the post

Sorry, I didn’t mean to imply that you had. I just meant that a JPM analyst might be more likely to take someone at their word on credit information, given that knowingly giving false information in that scenario would be fraud. But I certainly still see your point.

Uh-oh. Sharing that application form when Chase has already pulled it… seems like bad things may happen 🙁

If Jpm wanted to restrict the app only to PB clients, they should have added it to the terms and conditions. As far as I can tell, nothing in there that says only PB clients can apply.

This is true, doesn’t mean they need to approve you though.

My hope is that if they won’t approve if I’m not PB, then they won’t even run my credit.

So for someone who has not applied yet, do you guys recommend faxing it in or applying online? Any DP for online instant approvals?

There’s an online app???

lol my bad, it was just the benefits landing page. Sorry for any unintended excitement!

This post is just irresponsible.

Alert: a PBC may have been spotted

🙂

If the app is rejected for the reason of a lack of private banking relationship, will they still pull a credit check before rejecting?

Your guess as good as mine. 0 rejections reported so far, so no DPs for me to base it on.

You mention the call when — the JPM rep says something along the lines of “I see you have been aggressively applying for credit cards – why is that” — but never suggested a response. How did you or your friend respond to this question?

I surely mentioned his response, that he wanted to separate his personal expenses from his business expenses, of which he had several businesses.

Perfect, thanks.

They are apparently very backed up. A lot of suspense.

Learned of your post from Doc. Thanks for the info, my wife and I applied. Will see.

Any new DPs on approvals? Sounds like there’s still only the two.

Did you have checking or savings acct? Or did you have both?

Checking

Cool. Thanks!

My wife and I are CPC and have a total of about $115K in Chase; we met with the JPM banker shortly after we signed up with CPC but don’t have any JPM investments. She just got the CSR and my application is still in reconsideration. Worth applying for JPMR?

What’s a hard pull worth to you? If not much go for it.

I applied for the CSR but was denied. So I a applied and was approved for the Ritz. What are the chances I get approved for the JPMC Reserved?

Unsure at this point. My friend got approved for csr, fairmont, and Jpmr within 5 biz days.

Is the fax line down? I’m not able to send a fax over and “calling” it leads to a busy tone.

Indication from when I called in is that there won’t be much weekend activity on these apps. Would be kind of surprised if that’s true given how behind they are.

@Oscar which number did you call exactly? The Executive Line?

The standard Chase line – they then transferred me to some sort of lending team.

Fax wouldn’t go through when I tried either

Tried twice and fax isn’t going through 🙁

Same here, busy tone. I hope they just shut down for the weekend. I’d be pretty disappointed if I missed this.

Its a fast busy signal…guess we will see in a day or two if this continues.

Any other way to get it through? I’m assuming Chase’s central fax line won’t work.

Still getting a fast busy signal. I have a feeling they shut this gravy train off fast.

yep. Same here.

Those of you pending/approved: when did you fax it in? I faxed mine in 9/1 late at night, Pacific time.

I’m hoping they are not going to start applying 5/24 to these and turning off the fax number is their response, so any faxes that went in are fine.

Faxed on 8/25. Over 5/24 – still waiting.

did you hear anything yet? If you still didn’t maybe its all over for us 🙁 Good luck to you though

I faxed mine in on the first, and showed a HARD PULL, and then the card pending online. I got a voice message from them basically saying AFTER the hard pull and I was approved, they were reminding the card, and recommended I apply for a Chase card. Oh well. Was only a hard pull. Would NOT send in app unless you want a pull, and possibility of getting card, paying annual fee, and then having it downgraded.

Good try negative nancy. 1) there is no online app status check 2) no chance they got to your app within two days after all the thousands on top of the already thousands of apps received 3) the AF doesn’t hit that fast and if one cancels within 30 days of AF hit date, the AF is refunded.

BS!

How are your checking accounts doing NOW? I was right!

Negative nancy (as you put it)

How long is it taking to receive the JP Morgan Reserve card after fax if approved?

Still have not received mine yet but Jpm rep told my bud during the call he would receive it by this coming Tuesday so ~3 business days.

Chase called back today. They said minimum is $15k limit and they need to submit a request for a credit move in order for me to be accepted. Asked a bunch of questions about why I applied for card, etc.

Anyone have experiences with this? What are my chances now?

Chase reps work on Labor Day?? So are you conditionally approved?

Still pending I guess. I don’t think most of the company is working but he said he sent in a recommendation for approval or something of that nature

Still pending according to rep. Sounds like due to holiday, I won’t find out for a few days minimum

did you hear back? Please share your result so we will have an additional DP to pin our hopes on

I faxed my app late night on Sep 1st. No response yet. Would you share the date you applied? tks.

Did you hear anything back? Please share the DPs with us.

This sounds promising, I don’t see why they wouldn’t process a credit move. When on Thursday did you apply?

Morning. Hopefully you’re right. But the rep that called said it goes to a different department after he makes the credit line recommendation. So who knows

Craig: Do you bank with Chase or JP Morgan?

Chase

@Craig,

You mind letting us know if it was 8/25 or 9/1 that you applied? And are you a Chase Private Client or a Private Banking client or neither? Thanks for the DP.

when did you apply

8/25 – no and no

Anyone tried to apply for it without even being a regular checking client? Have a few cards but closed my business checking with them a while back…

Same question on my end. My only relationship w/ them is credit cards.

I applied with no Chase banking relationship on 9/1. I still don’t show a hard pull on any of my credit reports, but neither do most people who faxed theirs in around that time AFAIK.

Any one tried FAX in today? It won’t go through!

I tried on Friday and it wouldn’t go through.

Faxed in 10am 9/1 EST. no response yet.

typo, 10am 9/2

i called in they said that fax number doesnt work because the application had been leaked online.

Anyone faxed in 9/2, and got any response?

Thanks

Was declined for the CSR card so I faxed over the app for the reserve card a couple of weeks ago. I tried twice to check the status of the application, but it keeps on wanting to transfer me to a rep to talk to, so I hung up.

Ideas?

Who do you mean by “it”? And what number did you call?

Chase application status line. The automated operator after I enter in my SS. I hung up because they’d prob. ask me to contact my private banker or who my private banker was.

Happy to announce that my account was approved for 50k. 🙂

Did you call in or did it just show up in your account?

I called. They said I should have the card in a few days. I will report back assuming it arrives.

Card arrived today. Very similar to my palladium card back a few years ago. Though, not sure if it has any gold or palladium in it.

Very happy with my card.

I checked with my private banker today, they’re aware fax number leaked, and shut it down. There’s a new application now through the JPM PB branches. She said they would be reviewing all apps, and cards issued, and if not private bank relationship, account would denied, or if issued in error, be closed.

How could they possible close accounts already open, especially when cards are sent out? Seems like that would cause a huge problem.

If they can close accounts now, I’m surprised they didn’t close mistakenly-issued Palladium cards back when they were issued in error.

A PBC reading this blog – what are the chances of that? I guess two can play this game. I called up my PB today and while he admits JPM is aware of they leak they are approving all apps that made it through and not cancelling! (Jk)

Just tested the email address of “Rick” and not surprisingly, got the bounce back as no such email address exists.

Non private bank client here. I applied before the fax got shut down and was pending. Called the recon line today and had to go through verification of identity and was then approved. Curious if the last post is true or assumption from the banker that accounts without a private banking relationship would be closed. Guess we will know soon enough. OP, have you received your card yet? That might be a sign. I was told 2 weeks. This card already appears in my online account below my CSP.

A few questions. Are you over 5/24 and/or do you have any non-cc accounts with chase?

If it’s in your account, and your credit was pulled, and they verified your identity, I can’t imagine they would shut down your account.

Hard to imagine but totally within their rights. Chase/JPM can cease their relationship with you on any particular card at any particular time at their discretion, no reason needs to be given. The only reason they wouldn’t is to avoid cultivating bad feelings–but if they feel like they’re taking enough of a loss I’m sure they’ll eat the bad feelings and cancel.

Non chase private client here. I applied before the fax died (on 8/29 I think) and went pending (learned this by calling the Chase app status phone line). Called recon line today and had to verify identity and was approved. Curious if the last post about closing accounts is fact or assumption/heresay by your local branch banker. OP, or anyone, have you received your card yet? I was told 2 weeks from today. Card already shows up on my online account.

Got mine today.

Is the card metal? Like palladium or sapphire? Can you pm or post a pic?

Never had palladium so can’t opine. I can say it is metallic sounding when knocking it against a hard surface and not the cheapy heavy plastic feeling of the chase sapphire reserve card.

Coming shortly. In the meantime my friend has graciously shared his pic (top of the post).

A few questions. Are you over 5/24 and/or do you have any non-cc accounts with chase?

Also, When I called the chase app phone line it wanted to connect me with a customer service rep. Is this normal and if so should I talk to one?

I can’t say for sure. I’d have to check. I believe I’m either at 5/24 or 6/24. Only have CC accounts with Chase but there’s a box on the app that asks if you have a checkings/savings and I checked yes anyway (used to have acconts there but they’re either closed or inactive , definitely no money in them. Also thought it’d be an immediate rejection if I didn’t check those boxes). When I called the chase app status line, it said I was pending and would hear in 30 days. Since it wasn’t the 10 day message I knew I wasn’t denied (yet). So I called recon to see what the status was and they said they needed me to talk to the verification dept. Got transferred there and they just asked some questions to confirm my identity and then approved me on the spot. I would go ahead and talk to whomever. Hiding isn’t going to get your app approved and even if they know you’re not a client and applied anyway, you’re not in any trouble and apparently they’re not going to deny you either. Seems to me like they are honoring the apps since it’s their fault the app got out and their uninformed agents processed them anyway even though they weren’t submitted by private client bankers.

Thanks for the reply. When did you apply? I did 9/1 so I was unsure if they had even gotten to my app yet, which is why I held off on talking to anyone.

I applied 8/29. Did you call the Chase app status phone line? If so, and it says they received your app, they should also tell you whether you’ve been approved or you should get the 10 or 30 day message. If you get the 30 day message, I would call the Chase recon line because usually that means they just need more info from you to complete & approve the app.

There’s a box on every cc app that asks if you have checking and/or savings accounts. It never means at that bank but rather at any bank.

There was no question as to whether you have a PB account with Chase and I doubt they can easily match names/ss#’s since there are so many spread out PB clients and so many have their membership under their firm’s group account.

Chase does not want to offend a single PB client by accident trying to clamp down on “imposters”. The most diplomatic way for Chase would be to “lose” the recent applications that came in by the fax # before it was disconnected.

This particular app had the checking and savings account questions, but also a third question asking if those accounts were with JP Morgan or Chase. Not even the Ritz-Carlton online app (also through JPM) had that third question.

I agree with you, though, that the most diplomatic approach will simply be to pretend faxes were never received so that PBCs can simply apply again through their banker (a slight inconvenience, but far better than inadvertently closing their accounts), and those who make it through before their cutoff get lucky and get to keep it.

I called and after entering my SSN it immediately said I was being transfered to a phone rep. I had never experienced that before and assumed my app hadn’t gotten processed yet so I hung up. But maybe I should call tomorrow and just talk to them?

Where did you get application in the first place?

I hope the fax number is still working.

I just got approved for CSR, as a student for 2/24 and got a card one Sep 1, but I do t mind getting another one!

Faxed on Sep 1st around 10pm Eastern. Called app status today, immediately xfered to rep. No app in the system 🙁

Did they say that means they weren’t going to get it or that they hadn’t gotten to it yet?

Also curious. I applied at the same time on the same day. Wonder if we missed the “cutoff” or if tons applied and they are working through the backlog?

Has anyone else that applied heard anything?

I faxed my application in on 9/1 and decided to call up today to check on the status. I was immediately transferred to an agent who said there was no record of my application. I said I faxed it in over a week ago and was wondering if they were just backed up, and then the call turned confrontational… The agent said this card isn’t publicly available so I shouldn’t have sent the application in myself to begin with, and that this could flag my “client profile” and prevent me from getting approved for Chase credit cards in the future or even having my existing card accounts closed. !!! I made up some excuse about a banker emailing the application to me, but she wasn’t having it (she was surprisingly rude about it ), and then I hung up.

I hope she was just messing with me. All my existing Chase cards and points seem okay when I login, but I’m wondering if I should transfer everything out to United just to be safe. Anyone else have a call like this?

It’s highly unusual to hear them be that aggressive. I doubt you would get shut down over one CSR’s rant, though.

It’s unfortunate that you can’t complain about that CSR; even if what she said is true, it sounds as if she was unnecessarily confrontational and rude to a customer. However, you don’t want any more eyes on your stuff than you have to.

Is there a hard pull on any of your credit reports? If not, I’d simply let this one ride and see where it ends up. My suspicion is after they figured out it had leaked online, they simply started ignoring all faxed applications and sent new information to private bankers.

Nope, no hard pull according to Credit Karma and Credit Sesame (which I think covers all 3 bureaus?).

I was reading on Reddit that someone else had a similar threat made to them by a Chase agent. Ugh, it seems like all the banks are cracking down on “us” lately. I just transferred all my UR points to United and Hyatt, not going to risk it after what AmEx did to me (clawed back 100k MR points from the Platinum deal after they caught me using MS).

CK and CS only cover TU and EQ. You have to view EX on their own website (they offer a service equivalent to CK for free).

In NY, Chase pulls EX. It wouldn’t hurt to double check EX, but a lot of people are reporting not seeing any hard pulls so I’d let things sit.

As long as you’ll use United and Hyatt, I see no problem there. Gives you peace of mind and you’ll be able to redeem normally. I try to avoid speculative transfers, but I guess you have more of a reason in this scenario.

No hard pull for me either via CreditKarma or CreditSesame.

Same for me. No hard pulls on Credit Sesame, Credit Karma or Experian as of today.

I believe this is over and hope is lost …

Just following up. I posted above a few times but I received my card today. To recap, I applied on 8/29 and Chase did a hard pull on 8/31. Went pending 30 days, called in to the recon line and verified some personal identity questions on 9/6 and card arrived today 9/8. Seems like around 9/1 or 9/2 they caught on and shut down the fax. Looks like you probably had to have the app submitted by 8/30 or 8/31 latest. 🙁

Faxed in the app 9/1 and never got a hard pull. I assume they started ignoring apps around that time.

I’m in the exact same boat. A day late and 100,000 UR points short.

Same boat as well. At this point I care more about the card itself than the signup bonus…..

I faxed in 9/2, 10am.

no HP, nothing so far

Faxed around 2AM 9/2. Nothing. Called Chase card number. No luck. Spoke to an agent who saw no application in the system. Agent spoke to higher up. Indicated I should call 1-877-470-9042, which is just the Chase fraud department, closed for now.

This is likely a dead end. I have one other trick up my sleeve, bit of a long shot, but I’m giving it a go.

Care to share your one last trick?

I’ll share it if it works. My guess is probably not.

I think I know what trick you’re talking about and I tried it too. Really hope it works. Bummed I didn’t hear about this sooner.

Instead of calling Chase you go to your Chase account and look for the application status page (or something like that). Mine says no applications on file. It’s possible they shredded lots of apps, but due to the holiday it’s possible they’re not processed yet. Just a thought. Either way I didn’t expect this to work anyway. Once a trick goes public it’s curtains.

fyi that thing has never worked.

Has anyone heard anything re: their application recently? My credit monitoring service sent me an email this morning, and sure enough I had a Chase hard pull on 9/8. I checked my account but there’s no sign of an approval, and I have not yet received a call.

I think I faxed in my app on 9/1, but if not I was definitely on the late side of things. The hard pull gives me hope, but not having heard anything yet despite the pull being done on Thursday has me worried.

Give it a couple more days — maybe you’ll have a surprise new account listed when you login!

I sure hope so. I faxed on 9/2 and I’ve about given up hope. :'(

Which one did they pull?

TU, IIRC.

Update from Chase on the card?

Have you called the Chase app status line to see of you are pending or not? I had finally come to terms with missing out and you have to go and get my hopes up again, dang.

If you call the Chase app status phone line 888-338-2586 it will tell you what’s going on with this JP Morgan application too. If there’s no record of an application being received when you call that line, chances are it wasn’t received, or it was received but it will not be processed.

What is your relationship with Chase? PB? CPC? Chase deposit account? Chase credit card? Thanks.

Long history of CCs with Chase, no deposit accounts or others though.

Thanks for the update. Did you select ‘NO’ for having a Chase/JP Morgan Checking/Saving account on the application form?

I selected ‘NO’ and after a second thought, I could have selected ‘YES’ and opened Chase deposit account(s) shortly afterwards, but it had already been faxed… I opened a few Chase deposit accounts later anyway, but I am not sure it matters much at this point though.

Any more update?

Have checked the online app status and called the number to no avail. Pretty much resigned to having not gotten it at this point though I don’t know why they’d do a HP if the application wasn’t being considered. I’m thinking that there’s a good chance I’ll receive a letter in the mail soon letting me know I’ve been denied. Will definitely update if I hear anything back.

Anyone else heard anything?

I know I’m late to the party, but I couldn’t get my faxed application to go through to the fax number listed on the application form (1-877-576-2828). Anyone else have that problem?

They shut it down around 7/3

new data point… I came home from work and found my JPM reserve in front of my door. my boyfriend faxed it in on 9/1 so it appears they did not tear up apps sent in on 9/1. Perhaps it started after 9/1 or others will still get approved. It still has not shown up in my chase online account so if you still haven’t seen it there it definitely doesn’t mean it isn’t on the way. Thank you for all the great info on this site that helped me get approve for the jpm reserve when I was never preapproved for the sapphire product because I have too many cards. So freaking psyched to have that 100k!!

Well done – stoked for you

Congrats! When on 9/1 was it faxed? If you call 888-338-2586, what does it say? Thanks

It says “you have been approved… Your new card will arrive” my Bf faxed it in for me at 1045 on 9/1. My relationship with Chase is that I am on my bf’s private banking account and have a bunch of credit cards. I really wasn’t sure I’d be approved. I went through the same private banker my boyfriend did. We both got it. Good luck!!

Thanks for the data point. Your case is unique in the sense that there is some linkage between you and JPM private bank e.g. you may have still been approved regardless if you applied 9/1 or 9/10 because you are “qualified” in JPM’s eyes. Still TBD on approvals for 9/1 applicants with no JPM private bank relationship whatsoever.

I’m going with being a CPC was the reason. I have yet to see any other data points of non-CPC applications being apprived post 7/1

I believe she mentioned Private Banking, which I interpret to be JPM Private Banking, requiring $10MM with JPM. CPC is a lower level requiring only 250k with Chase.

Private banking or private client?thanks

Also, what is your relationship with Chase? Thanks again.

Did the app show up on the automated application line (800-432-3117), or did it still say you have no applications on file in the past 30 days?

I actually never called in. Was letting my bf handle and he was waiting for the private banker to get back to us. I thought it was a bad sign that it was not showing up online like for other people but then it just showed up. The banker called me today to say I was approved. Haha.

so lucky. Hope more people will get it

Applied on 9/1 and have just called the number above and there’s no record of the application after 2 weeks.

If I’m not getting it I want to get the Fairmont card since it seems iffy that Chase is keeping it as is (it’s on the Fairmont site but not on Chase’s). 2 free nights after $3K spend and waived annual fee. Not subject to 5/24.

applied on 2/9. every time i call the number it directly wants to transfer me over to a person. i then entered an incorrect SSN on purpose and it says “info does not match our record”.

has anyone who got transferred over not get threatened? i don’t want to be chewed over the phone lol

I transferred over, was not threatened. Didn’t get anywhere.

Quick question: approved for CSR, is there any difference or benefit other than the 100K points to get the JPM Reserve? And, am I even able to apply for the JPM Reserve as it appears the fax number has been shut down.

JPMR comes with unwritten benefit of United Club membership – My United mobile app now reflects membership. No alt. method known to submit JPMR app unless you are JPM private bank client.

How do you apply for the United club access? I can’t remember when I applied. I think it was 9/2. I got worried about the fax number day after I submitted and then put credit fraud alert on. Got an email on 9/3 which was the date I applied that alert. Around 9/13 or 9/14 received call to confirm information since had the alert. Card was granted and arrived today.

Just read how to get it thanks. On another note the palidum card loophole how fast were people’s accounts closed that weren’t PB clients?

So you applied after 9/1 and got the card?

I cant remember if I applied 1 or 2 days before I put the credit alert on. That alert was put in place on Friday 9/2. I got the emails on 9/3 confirming it was placed but I know I applied the alert on a workday. So I must have sent in before 9/1. Sorry for the confusion. On another note I had already have PP activated on the Sapphire Reserve, when I tried to activate on JPMR it already showed active and on Saturday I received another PP membership card.

around what time on Friday (9/2) did you apply? I applied on Friday morning and I didn’t hear anything yet…are u PB? or CPC?

Has anyone had any success getting their applications sent in by their PB rep since the fax# went down? Is that worth a try?

if you are JPM PBC you should have no issues getting the app through via your banker.

Lurkers keep saying if you received JPMR and aren’t a PB client, the card will be cancelled. Any DPs on cancellations with the now legacy Palladium for those that applied trough the loophole and weren’t PB clients? Meaning, were those accounts eventually closed or not?

Well, I sent in the paper application via fax on September 1 at 2:30pm, and I still haven’t received anything. No response whatsoever. I called in to check, and there’s no record of the application. I’m stumped.

Anyone have any advice?

Nope. See above for cutoff dates.

How did you apply and get approved without meeting the supposed $10 Million requirement? I called the cards service number today and wasn’t given any clear details as to the requirements of the card, but was told that it was invite only and that I should speak to one of their bankers if I wanted more information.

Update: I went to a private client branch and was told that the card was for private client members only and that there is no $10 million requirement, that it was however invite only for private clients (meaning you have to have $250,000 invested with JPMorgan Chase). When I told the private client rep that you and your friend weren’t private clients and in fact only had $1,000 with Chase, he told me that if I could provide your name in order to find the account and see how you applied and got accepted that there would be no issue in getting me a JPMorgan Reserve card.

What Private Client Branch did you apply at?

Funny I was approved and got the card. Today I got a letter saying that my application was not submitted since it was not sent in through authorized channels for this card. Wonder if they will cancel the card. They did just charge me the AF for it.

Oh, interesting, I got a similar letter today: “We’re writing to let you know that we are unable to process your application for the J.P. Morgan Reserve credit card. The application was not considered because it was not submitted through the process authorized for this credit card.”

It’s dated Sept. 27, but I had been wondering whether it was actually triggered by me calling the status line or applying for a CSR late Sept. 29 / early Sept. 30, and they just backdated the letter. Given your letter, that seems unlikely.

I got the exact same letter today. I never called to check the status and never received the card.

Got the same letter yesterday, also dated Sept. 27th, but I was never approved for the card. I was rejected over the phone when I called on Sept. 7th, so it seems they are just getting around to sending out these letters to people who tried to submit apps through the fax line.

I fell victim to the AmEx 100k Platinum clawback fiasco, and I’m not going to risk having Chase take my points too. Transferred all my UR points to United and Hyatt last month. Be careful out there.

I also got the same letter dated 9/27. I haven’t applied any other Chase cards.

Well, sh!t. My Chase checking and savings accounts just got frozen, although my Chase credit card accounts are still okay. I tried calling in to see what the problem was and got transferred to a different department that told me “this wasn’t a mistake” and that I’m supposed to get a letter with more detail in the next week or two.

I did some Googling and found this thread on FlyerTalk: http://www.flyertalk.com/forum/chase-ultimate-rewards/1526572-chase-closed-my-credit-card-account-s-consolidated.html

It sounds like getting your checking/savings accounts frozen is the first step when getting blacklisted by Chase, and the credit card accounts get closed later. Not sure if this is related to my JPM Reserve application, but I can’t think of anything else I’ve done to anger Chase. I don’t do MS on my Chase cards, no MO deposits, I always keep at least $15,000 in checking/savings, etc. I already transferred out my UR points, but really don’t want to get blacklisted since I legitimately use my Chase cards. Any advice?

From reading forums, and how fast they shut down the application fax hold, I’d doubt there not going to do SOMETHING with the ‘leaked application” JPM Reserve cards that were not put in internally through JP Morgan or Chase Private Client. I figured they turn them into Chase Sapphire Reserve account though with new number once metal cards returned. Never suspected a full freeze of account. Anything else it could be from your spending on checking accounts? Hopefully JPM has better things to do with their time and assets.

My Chase cards have all been frozen as of this morning.”Your account is closed and no longer available for use. If you have a balance remaining on the account, please continue to make monthly payments by the due date. Thank you.”

I can’t think of what else it could possibly be. My checking account has very little activity — two direct deposits (from my employer), maybe one or two ATM cash withdrawals per month, and I pay my credit card bills from the account. That’s literally it.

I knew I was taking a risk by applying for this card, but didn’t think it would come to this. I read a few other forums and it looks like once the accounts are closed it’s all over. At least I got my points transferred out.

I wonder if this is related to the Wells Fargo scandal? Maybe Chase is shutting down all the unauthorized JPMR apps because they were submitted through “fraudulent” means and could get the company in trouble? I dunno..

Just logged into Chase.com, and my checking account AND credit cards (Sapphire Preferred, Hyatt, IHG, and BA) have *ALL* been closed. UGH!!!!! 1st time anything like this has happened to me. Tried calling the number on the back of my Sapphire card and after being transferred to a supervisor, was told that “Chase has decided to close your accounts due to an unsatisfactory relationship.” WTF is that supposed to mean? I’m to get a letter with an explanation in “about a week.”

The JPM Reserve card is the only card I’ve applied for in over 3 months, no money orders, and just one $1k gift card purchase from two months the ago to hit the minimum spend on Hyatt. Can’t think of any other reason why this would happen. This is f**king bulls**t!!! I’m walking into my nearby Chase branch and demanding that I speak to the manager there. Can a bank really just close accounts like this?

Same thing happened to me. All my Chase accounts got closed, banking and credit cards. I don’t think the people in Chase branches will be able to do anything (I tried that), but good luck.

Did you trying calling to follow-up on your JPMR app? I wonder if that was the trigger.

I would quickly set up account other institution, and just move on from Chase. I know you understood there was a risk, but it seems silly tbh for them to be so reactive. I know banks maintain a credit reporting system through their own that they share, as well as soft pulling 3 credit reports which will take a hit from your situation. Interested to hear if it was just faxing the JPM app. I’m quite sure they are reading every post on this board.

I still have a checking account and credit cards open at Citibank, so I’m ok. Just a big hassle to move things back, and being blacklisted from Chase is obviously the worst part since they have some of the biggest credit card bonuses around. Now I’m just hoping they don’t ding my Chex Systems report..

Yeah, this is really harsh. I get it, I applied for a card I shouldn’t have because I don’t have the $10 million at JPM or whatever, but to sever all ties when I’ve never had a late payment, always pay the balance in full, etc. is something I wouldn’t have expected in a million years. The one silver lining is that I can hit the other banks harder, now that I don’t have to manage around 5/24.

Hrm, I did call to follow-up but they said there was no record of my JPMR application, and that was pretty much the end of it. I had to give them my social security info though, so it’s possible they could have flagged me based on that?

I was just reading on FlyerTalk and a couple of members who have a history of posting accurate info said about a week ago that “fraudulent” accounts were being “purged,” but not until December 7th. Maybe calling in just speeds up the process?

I’m going to stop by that Chase branch once I get off work today.

My Chase branch was completely unhelpful. They could see that my accounts had been closed, but wouldn’t give me any info on why. And the branch manager was clueless.

Not sure what else to do? I already tried the number on the back of my card, the “executive line”, and now a Chase branch. Any other numbers I can call?

I would guess that a number of people who posted to and acted upon this thread are quite worried now as a result of the above reports?

Please post your experiences so we can know what we may be in for!

Thanks!

I’m in email contact with the guy who runs this blog. I’ll send him a copy of the letter once I get it so that he can share it with/warn everybody.

Chase allowed me to convert the UR points from my closed CSP card into a statement credit. Better than nothing I guess.

At what rate 100k = $1000 ?

Yep, 1 cpp. I asked to transfer to United but they told me the only thing they could do was a statement credit.

You’d think by now if cancellations of accounts, would be more than 2. Will be interesting to see letter and if more behind scene!

I have the card. It’s pretty cool, but very heavy. Waiting on my UA card now!

ps. I show I have United membership now, even though I have not received the card in the mail yet. Now I just have to fly United, something I haven’t done in like 20 years! 🙂

Trying to figure out what other special benefits the JPMR card will offer me now. I guess we will have to wait and see what shows up in the mail…

Wouldn’t you be paying 2 yearly fees of $450 and then have to cancel one of them which would negatively effect your credit score?

One can always keep one and downgrade the other to a freedom or freedom unlimited to maximize.

Where’s the supposed letters of cancellations of peoples accounts JUST for applying to this card?

nothing yet. So far I haven’t seen any proof of any cancellations.

“Banks are urged by federal law enforcement agencies and regulators to close questionable accounts — or else risk getting hit with penalties. So they often end up shutting accounts even when a customer isn’t doing anything explicitly illegal.”

“What it all comes down to is that your bank reserves the right to shut your account at any time, for any reason. And because the institution is held liable if an account ends up being connected to fraud or damaging the reputation of the bank, it is often going to take a “better safe than sorry” approach, said John Ulzheimer, credit expert at CreditSesame.com.”

“Nobody has the right to a credit card, a bank account, a debit card or a merchant account,” said Ulzheimer. “You have to earn it and the banks set the rules. If you are what they perceive to be too risky, they’ll shut you down and you have no recourse.”