Updated on April 5, 2017

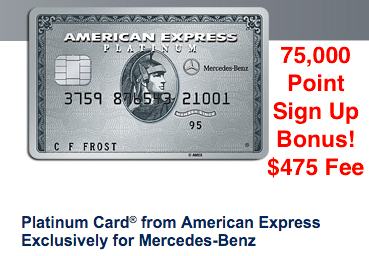

75,000 Sign Up Bonus – Amex Platinum Mercedes Benz

American Express is offering a big 75,000 sign up bonus for their Mercedes Benz Platinum Card. It comes with a big $475 annual fee but the long list of benefits can easily make it worth it, if you take advantage of a few of them.

Application Link

- 75,000 Membership Reward Points – Sign up Bonus [Public offer, not an affiliate link]. Expires 6/22/16.

Should I Apply?

- I did but it may not be right for everyone. Usually this card offers 50k bonus points – this 75k bonus is the highest offer I have seen. Keep in mind the bonus is only available if you have never had this card in the past (once per lifetime).

- If you are just looking for the benefits of the card but are worried about the annual fee, The Platinum Card from American Express for Ameriprise Financial (public offer/not affiliate link) offers mostly the same benefits (without the 75k bonus) but waives the first year's $450 fee. So, basically you are paying $475 for the 75k Amex points.

- I signed up for the card because I want the points and think the benefits easily take care of the $475 fee – mainly due to the $200 Airline Fee credit that I can get twice (once per calendar year). Lastly, I have already had most Amex products, so I'm running out of bonuses I can get. Since this is the biggest bonus for this card, I jumped on it. Newbies may want to focus on getting their Chase cards (Sapphire, Ink) before this due to Chase's new rules.

- Yes…if the rumors that Amex will soon relax the rules on getting sign up bonuses are true. See Reddit and MMS.

Am I eligible?

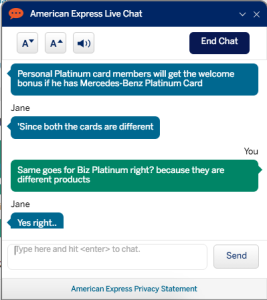

There are two lines in the terms and conditions to look at:

- Welcome bonus offer not available to applicants who have or have had this product.

- This offer is not valid for existing Platinum Card Members from American Express.

If you have ever had this exact card, then no you cannot get the bonus. I asked Amex about the second bullet and they said business and personal platinum cards are different products, so yes you would qualify.

Benefits

There are lots of benefits to this platinum card, though many of them are likely to go unused. Here are the main benefits I think most people will be interested in:

- 75k bonus Amex Points after $3k spend + $475 fee

- $200 stmt credit x 2 = $400

- Hilton & SPG Gold Elite Status

- $100 free Mercedes accessories

- Boingo Wifi

- Lots of free airport lounge access: Centurion Lounge, Delta Sky Club, AirSpace Lounge, Priority Pass Select

- $100 Global Entry Credit

HIGH VALUE

- 75,000 Membership Reward Points after spending $3,000. This is the highest offer I've seen for this card. These points are most valuable transferred to partner airlines.

- $200 Airline Fee Credit – Since you get this every calendar year, this is worth $200 this year + $200 next year = $400. See my other post on how to use this for Amazon credit instead of Airline fees.

- Lounge Access – Access to over 900 airport lounges including:

- Centurion Lounge – Access to excellent lounge for you + up to two guests

- AirSpace Lounge – Access for you + spouse + kids under 21 OR up to 2 companions. No ticket is required. 4 Locations: JFK T5, CLE, BWI, SAN. Value: $20-$25 per person per visit.

- Delta Sky Club – Access just for you when you fly Delta. Cost for additional guests depends on the club. Details, Locations, perks can be found here.

- Priority Pass Select – You must enroll here to get access to 600+ lounges in 100 countries no matter which carrier or class you are flying. Access for you only. Guests are $27 per person. You can also enroll by calling 800-525-3355 (Platinum Card) or 800-492-8468 (Business Platinum Card)

- Free Boingo Wifi – unlimited wifi at over 1 million hotspots worldwide

- Hotel Elite Status – Hilton & Starwood Gold Status

- Hilton HHonors Gold Status – Gold status is valuable mainly for the free breakfast. How much can breakfast cost? How about $100 per person at the Conrad Maldives where we stayed for our honeymoon. Gold usually takes 20 stays/40 nights to obtain.

- Starwood Gold Status

- Dispute Resolution – American Express has the “least pain in the butt” credit card dispute resolution process I have ever experienced. Have a problem with a charge? Just go online, click a few buttons, and done. Don't expect they will always respond in your favor.

- Fee Credit for Global Entry or TSA Pre✓ – Amex pays for either program – $85 or $100.

MEDIUM VALUE BENEFITS

- $100 Certificate for Mercedes Benz Accessories at your local dealership. Mommy Points picked up some MB branded bags, shirts, cups, notebooks, etc. Value to me: $0 but I will stop by a dealership to use my certificate. How do you get it? It will be mailed 6-8 weeks after the membership fee is billed (probably in case you cancel the card).

- Concierge – Call 800-525-3355 (Option 2) or 617-622-6756 (call collect when you are international). I don't need this often but they did help me secure show tickets in Vegas for a large group. Everyone else could only get a 3-4 tickets sitting together.

- Car Rental Elite Status – get membership in National Emerald Club Executive, Avis Preferred, Hertz Gold Plus Rewards. To enroll in any or all of these programs log onto americanexpress.com/platinum or, for Hertz Gold and National Emerald Club, call 800-525-3355 to sign up.

- No Foreign Transaction Fees

LOW VALUE

The following benefits have a value close to $0 for me mainly because it is unlikely I will ever use them. I would focus on the higher value benefits mentioned above if you are considering this card.

- $1,000 Certificate – use towards purchase or lease of a Benz after $5,000 spend. Value to me $0 but if you're looking to get a Benz, this is worth $1,000. It expires 1 year after issue date.

- 2,000 Excess Mileage Waiver – only valuable if you lease a car

- American Express Preferred Seating

- American Express Presale

- By Invitation Only – Sometimes credit cards have invite only special events which are fun and exclusive, but I wouldn't pay for this benefit because it's very random.

- Cruise Privileges Program – I'm pretty sure I can find a better price for a package if I wanted to go on a cruise.

- Destination Family

- Double Membership Rewards Points – valid for travel purchases made through AmexTavel.com. I don't ever use them to book my travel, so this isn't worth much.

- Entertainment Access or Membership Experiences – I've never used this

- International Airline Program/Companion Ticket – I probably won't ever pay for a full priced business/first class ticket so cannot utilitize this service.

- Membership Rewards Pay With Points – Horrible use of points! The conversion is usually a rip off so I do not recommend doing this.

- Platinum Villas

- Premium Roadside Assistance – could be useful if you have or rent a car

- Free ShopRunner membership – free 2 day shipping but little value if you have Amazon Prime (free prime trial available).

Reader Rating

[yasr_visitor_votes size=”large”]

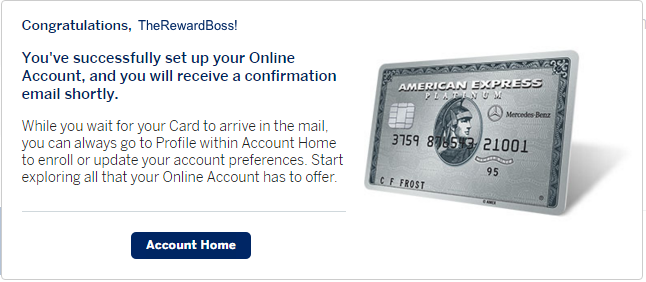

My card arrived… I was expecting some Mercedes Benz info but for the most part, this is a regular Platinum card with the small Mercedes logo on the card.

Related

- Great Deal! 75K Membership Reward Points with the Amex Platinum Mercedes Benz

- 75,000 Bonus Membership Rewards For American Express Platinum

Hat Tip: Reddit

Hi there… I just received my Amex Mercedes-Benz Platinum card and I’m excited to use the benefits. I was just wondering if I’ll get as much value out of it to offset the higher annual fee. I don’t travel as frequently as many folks, but I was hoping to still get enough value out of it to justify the annual fee

I think the first two bullet points I’ve listed in the High Value section would move than offset the annual fee. You can always cash in your Amex points for gift cards like Home Depot or other stores that everyone can use. It’s not a good deal compared to using it for travel but worst case you can use it for this.

I agree that using MR points for things other than travel wouldnt represent a good value. I do plan to use the points in travel. But after the first year with the card, how do you justify paying the annual fee in year 2 and beyond?

If you are not able to take advantage of the travel benefits, it would be tough. The Ameriprise Platinum is another option as you’ll get the benefits with no fee (and no bonus points).

offer terms say: “Welcome bonus offer not available to applicants who have or have had this product.”

and

“This offer is not valid for existing Platinum Card Members from American Express”

do you think this means that if i had previously had a regular amex platinum card i will be eligible for this offer?

This is a different product so you should qualify. I confirmed with Amex and posted the convo.

Also, I had the regular biz platinum not long ago and they also confirmed I am eligible for this bonus offer.

Nice! Thanks for that information!

Thanks for the write-up. I am curious on the rules for the $200 airline airline spend statement credit. It states that it’s for “incidental air travel fees”, which seems to exclude airline ticket charges. What are your thoughts on this?

Barry

That’s right, but this has worked for gift cards in the past. Have you checked out this post yet?

On the MB $1k certificate and the $2k waiver do they have expiration dates on them?

I added the links to details in the post. The $1k certificates expire within 1 year from the date of issue per the terms. The 2,000 excess is miles not $2k, and I assume its also one year but the didn’t write the date (see link)